Covered call

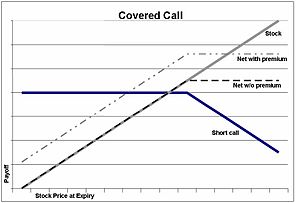

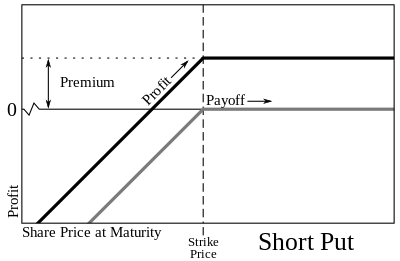

A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrument, such as shares of a stock or other securities. If a trader buys the underlying instrument at the same time the trader sells the call, the strategy is often called a "buy-write" strategy. In equilibrium, the strategy has the same payoffs as writing a put option.

The long position in the underlying instrument is said to provide the "cover" as the shares can be delivered to the buyer of the call if the buyer decides to exercise.

Writing (i.e. selling) a call generates income in the form of the premium paid by the option buyer. And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. The risk of stock ownership is not eliminated. If the stock price declines, then the net position will likely lose money.[1]

Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price (or premium) should be the same as the premium of the short put or naked put.

Marketing[]

This strategy is sometimes marketed as being "safe" or "conservative" and even "hedging risk" as it provides premium income, but its flaws have been well known at least since 1975 when Fischer Black published "Fact and Fantasy in the Use of Options". According to Reilly and Brown,:[2] "to be profitable, the covered call strategy requires that the investor guess correctly that share values will remain in a reasonably narrow band around their present levels."

Two recent developments may have increased interest in covered call strategies: (1) in 2002 the Chicago Board Options Exchange introduced a benchmark index for covered call strategies, the CBOE S&P 500 BuyWrite Index (ticker BXM), and (2) in 2004 the Ibbotson Associates consulting firm published a case study on buy-write strategies.[3]

This type of option is best used when the investor would like to generate income off a long position while the market is moving sideways. It allows an investor/writer to continue a buy-and-hold strategy to make money off a stock which is currently inactive in gains. The investor/writer must correctly guess that the stock won't make any gains within the time frame of the option; this is best done by writing an out-of-the-money option. A covered call has lower risk compared to other types of options, thus the potential reward is also lower.

See also[]

- Married put

- Option screener

References[]

- ^ (2009). "Chapter 12: Buy-Write--You Bet". Options Volatility Trading: Strategies for Profiting from Market Swings (1 ed.). Amazon.com: McGraw-Hill. pp. 188, 177–193. ISBN 978-0-07-162965-2.

When volatility is high, some investors are tempted to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker. But volatility is also highest when the market is pricing in its worst fears...overwriting strategies that are dynamically rebalanced ahead of large market rallies or downturns can naturally enhance the returns generated, say Renicker and Lehman's Devapriya Mallick.

- ^ Reilly and Brown. "Investment Analysis and Portfolio Management." South-Western College Pub. p. 995

- ^ Buy Writing Makes Comeback as Way to Hedge Risk, Pensions & Investments, (May 16, 2005)

External links[]

Bibliography[]

- Brill, Maria. "Options for Generating Income." Financial Advisor. (July 2006) pp. 85–86.

- Calio, Vince. Covered Calls Become Another Alpha Source." Pensions & Investments. (May 1, 2006).

- "Covered Call Strategy Could Have Helped, Study Shows" Pensions & Investments, Sept. 20, 2004, p. 38.

- Crawford, Gregory. "Buy Writing Makes Comeback as Way to Hedge Risk." Pensions & Investments. May 16, 2005.

- Demby, Elayne Robertson. "Maintaining Speed -- In a Sideways or Falling Market, Writing Covered Call Options Is One Way To Give Your Clients Some Traction." Bloomberg Wealth Manager, February 2005.

- Feldman, Barry, and Dhruv Roy, "Passive Options-Based Investment Strategies: The Case of the CBOE S&P 500 BuyWrite Index." The Journal of Investing . (Summer 2005).

- Frankel, Doris. "Buy-writes Catch on in Sideways U.S. Stock Market." Reuters. (Jun 17, 2005).

- Fulton, Benjamin T., and Matthew T. Moran. "BuyWrite Benchmark Indexes and the First Options-Based ETFs" Institutional Investor—A Guide to ETFs and Indexing Innovations (Fall 2008), pp. 101–110.

- Szado, Edward, and Thomas Schneeweis. QQ_Active_Collar_Paper_website_v3 "Loosening Your Collar: Alternative Implementations of QQQ Collars.[permanent dead link]" CISDM, Isenberg School of Management, University of Massachusetts, Amherst. (Original Version: August 2009. Current Update: September 2009).

- Kapadia, Nikunj, and Edward Szado. "The Risk and Return Characteristics of the Buy-Write Strategy on the Russell 2000 Index." The Journal of Alternative Investments. (Spring 2007). pp. 39–56.

- Renicker, Ryan, Devapriya Mallick. "Enhanced Call Overwriting." Lehman Brothers Equity Derivatives Strategy. (Nov 17, 2005).

- Tan, Kopin. "Better Covered Calls. Covered-Call Writing Yields Higher Returns in Down Markets." Barron's: The Striking Price. (Nov 28, 2005).

- Tan, Kopin. "More Bang, Less Buck. Selling Call Options." Barron's, SmartMoney. (Dec. 2, 2005).

- Piazza, Linda. "Options 101: Fashion Revival" OptionInvestor.com, Option Investor, Inc. (Oct. 3, 2009).

- Hill, Joanne, Venkatesh Balasubramanian, Krag (Buzz) Gregory, and Ingrid Tierens. "Finding Alpha via Covered Index Writing." Financial Analysts Journal. (Sept.-Oct. 2006). pp. 29-46.

- Lauricella, Tom. "'Buy Write' Funds May Well Be The Right Strategy." Wall Street Journal. (Sep 8, 2008). pg. R1.

- Moran, Matthew. "Risk-adjusted Performance for Derivatives-based Indexes - Tools to Help Stabilize Returns." The Journal of Indexes. (Fourth Quarter, 2002) pp. 34 – 40.

- Schneeweis, Thomas, and Richard Spurgin. "The Benefits of Index Option-Based Strategies for Institutional Portfolios" The Journal of Alternative Investments, Spring 2001, pp. 44 – 52.

- Tan, Kopin. "Covered Calls Grow in Popularity as Stock Indexes Remain Sluggish." The Wall Street Journal, April 12, 2002.

- Tergesen, Anne. "Taking Cover with Covered Calls." Business Week, May 21, 2001, p. 132.

- Tracy, Tennille. "'Buy-Write' Is Looking Attractive." The Wall Street Journal. (Dec 1, 2008). pg. C6.

- Whaley, Robert. "Risk and Return of the CBOE BuyWrite Monthly Index." The Journal of Derivatives (Winter 2002) pp. 35 – 42.

- Options (finance)

- Technical analysis