Huntington Bancshares

| Huntington National Bank | |

| Formerly | P. W. Huntington & Company |

| Type | Public |

| Nasdaq: HBAN S&P 500 Index component | |

| Industry | Banking |

| Founded | 1866 as P. W. Huntington & Company in Columbus, Ohio |

| Founder | P.W. Huntington |

| Headquarters | Columbus, Ohio 39°57′40″N 83°00′02″W / 39.961153°N 83.000594°WCoordinates: 39°57′40″N 83°00′02″W / 39.961153°N 83.000594°W |

Area served | Indiana, Kentucky, Michigan, Ohio, Pennsylvania, West Virginia, and Illinois |

Key people | Stephen D. Steinour, Chairman, President & CEO Zachary Wasserman, CFO |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 25,693 (2021) [3] |

| Website | huntington |

| Footnotes / references [4] | |

Huntington Bancshares Incorporated is a bank holding company headquartered in Columbus, Ohio. The company is ranked 500th on the Fortune 500,[5] and is 35th on the list of largest banks in the United States.

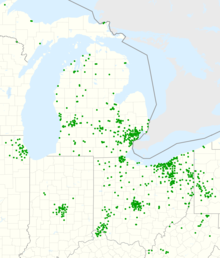

The company's banking subsidiary, The Huntington National Bank, operates 920 banking offices, primarily in the Midwest: 459 in Ohio, 290 in Michigan, 51 in Pennsylvania, 45 in Indiana, 35 in Illinois, 29 in West Virginia, and 10 in Kentucky.[6] [7] In January 2009, the bank's Board of Directors named Steve Steinour as president, CEO, and chairman, succeeding Thomas Hoaglan, who retired after eight years in those positions.[6]

The company is the second-largest originator of Small Business Administration loans.[8]

History[]

P. W. Huntington formed P. W. Huntington & Company in 1866, operating on the northwest corner of High and Broad Streets.[9] Huntington built its first five-story building in 1878, on the intersection's southwest corner. Four out of five sons of P. W. would become partners during the 1890s and early 1900s. The bank was incorporated in 1905 as The Huntington National Bank of Columbus.[10] Huntington died in 1918 shortly after turning the bank over to his sons.[11]

Francis Huntington became president and provided active leadership for 14 years.[12] In 1915, the bank received limited trust powers. In 1922, the bank received full trust powers from the Federal Reserve System. In 1923, Huntington purchased Columbus-based the State Savings Bank & Trust Company and the Hayden-Clinton National Bank of Columbus, swelling its capital base.[13]

In 1958, Huntington acquired the Columbus-based The Market Exchange Bank Company. In 1962, Huntington acquired both First National Bank of Grove City and The People's Bank of Canal Winchester. In 1963, Huntington acquired both The Columbus Savings Bank and the Columbus-based The Northern Savings Bank. In 1966, Huntington Bancshares Incorporated (HBI) was established as a bank holding company.

In 1967, Huntington Bancshares acquired the Washington Court House-based The Washington Savings Bank. In 1969, it acquired the Ashland-based Farmers Bank. In 1970, it also acquired the Bowling Green-based The Bank of Wood County Company, the Toledo-based The Lucas County State Bank, and Lagonda National Bank of Springfield. In 1971, Huntington Bancshares acquired First National Bank & Trust Company of Lima, The Woodville State Bank, and the Kent-based The Portage National Bank. In 1972, it acquired The First National Bank of Wadsworth and The First National Bank of Kenton, also establishing the first 24-hour, fully automated banking office.

In 1973, Alger Savings Bank merged into an affiliate in Kenton, Ohio. In 1976, The Huntington Mortgage Company formed as a subsidiary of Huntington Bancshares with The Pickerington Bank being merged into the bank. In 1977, Huntington Bancshares acquired The Bellefontaine National Bank, The Central National Bank of London, and Columbus-based The Franklin National Bank. In 1979, a loan production office opened in Dayton, Ohio.[13]

In 1975, the company changed its logo to its current "honeycomb" logo.

In 1980, Farmers & Merchants Bank, Milford Center and The First National Bank of Burton were merged with Huntington Bancshares.[13]

In 1981, the bank acquired Alexandria Bank Company and renamed it The Huntington State Bank, with a loan production office opening in Cincinnati, Ohio.

In 1982, the bank merged with the Reeves Banking and Trust Company.[13] Huntington acquired the tiny Savings Bank of Chillicothe, Ohio in the early 1980s, which gained some fame in 2011 when 100-year-old June Gregg revealed to Huntington officials that her father had opened a savings account for her as a baby with Savings Bank in 1913 and that she had subsequently kept the account open. Huntington officials later confirmed it and gave her account a temporary increase in her interest rate to 5% as a centenarian present for her 98-year loyalty to Huntington and the Chillicothe branch's predecessor, Savings Bank.[14]

In 1983, the bank acquired Cleveland-based Union Commerce Bank.[15]

In 1997, the bank acquired First Michigan Bank Corporation of Holland, Michigan.[16][17][18]

In 2002, the company sold its branches in Florida to SunTrust Banks for $705 million.[19][20][21]

In March 2006, the company acquired Unizan Financial.[22][23]

In July 2007, the company acquired Sky Financial Group Inc. based in Bowling Green, Ohio, which increased its presence in Indiana and Ohio and expanded it into Western Pennsylvania for the first time.[24][25][26][27][28]

In November 2008, the United States Department of the Treasury invested $1.4 billion in the company as part of the Troubled Asset Relief Program and in December 2010, the company repaid the Treasury. The U.S. government made a profit of over $144 million from its investment in the company.[29][30][31][32]

In 2009, Huntington bid against rival Fifth Third Bank to acquire National City Corp. branches in the Pittsburgh region from PNC Financial Services. The United States Department of Justice ordered PNC to sell the branches to comply with United States antitrust law concerns after the National City acquisition by PNC.[33] Ultimately, PNC sold the overlapping branches to First Niagara Bank.[34]

On October 3, 2009, the Federal Deposit Insurance Corporation named Huntington as receiver of a $400 million deposit portfolio from the bank failure of Warren Bank in Warren, Michigan.[35][36][37]

On December 18, 2009, Huntington signed a 45-day lease with the FDIC to run a bridge bank for the failed Citizens State Bank in New Baltimore, Michigan.[38][39][40]

In March 2012, the bank acquired Dearborn-based Fidelity Bank.[41][42][43][44]

In 2012, Huntington was in merger discussions with Flint, Michigan-based Citizens Republic Bancorp. Discussions stalled and FirstMerit, which was itself acquired by Huntington in 2016, purchased Citizens Republic in September 2012.[45][46]

In the first quarter of 2013, Huntington changed its ATMs to new ones that allow customers to make deposits by inserting cash and checks directly into the ATM.[47] The bank started in 2014 offering ATM deposits from mobile phones and through online transfers until 11:59 p.m. and post them that day.[48]

In March 2014, the company acquired Ohio-based Camco Financial, holding company for Advantage Bank, for $97 million in stock.[49][50][51][52]

In September 2014, the company acquired 24 offices of Bank of America in Central Michigan, including the Port Huron, Flint, and Saginaw markets. This raised the number of Huntington branches in Michigan to 173, including over 40 locations housed in Meijer stores.[53][54][55]

In March 2015, the company acquired Michigan-based Macquarie Equipment Finance, Inc. from Sydney, Australia-based Macquarie Group for $458 million.[56][57][58]

In January 2016, Huntington announced it would purchase Akron-based FirstMerit Corporation for $3.4 billion, making it one of the largest banks in Ohio.[59] Due to Sherman Antitrust Act concerns by the United States Department of Justice, it sold 11 branches in Canton and two in Ashtabula to First Commonwealth Bank.[60] Additionally, 107 branches located within 2.5 miles of other Huntington / FirstMerit branches were closed.[61][62][63]

Historic checks[]

In 2012, Huntington started displaying old checks that were written by famous people, including 24 former U.S. Presidents such as Abraham Lincoln, George Washington, Thomas Jefferson, Andrew Jackson, Theodore Roosevelt, Franklin Roosevelt, and Niles, Ohio native William McKinley. Other checks were signed by Charles Dickens, Thomas Edison, Ernest Hemingway, and Susan B. Anthony, among others.[64] The most notable check was one written by Lincoln to "self" for $800 dated April 13, 1865, the day before his assassination.[65] The checks are estimated to be worth over $75,000 today. Huntington acquired the checks in 1983 when it purchased Union Commerce Bank and received several boxes of old documents, but weren't discovered until 2011 when a Huntington employee was looking through the documents.[66]

Huntington Preferred Capital[]

Huntington Bancshares also operates Huntington Preferred Capital, Inc., a real estate investment trust (REIT). It was organized under Ohio law in 1992 and designated as a REIT in 1998. Four related parties own HPCI's common stock: Huntington Capital Financing LLC; Huntington Preferred Capital II, Inc.; Huntington Preferred Capital Holdings, Inc.; and Huntington Bancshares Incorporated. All these entities are tied via ownership and/or interlocking directorships to Huntington Bancshares, either directly or through Huntington National Bank.

In addition to the common stock, Huntington Preferred Capital also issued two million shares of preferred stock, paying a quarterly cash dividend of $0.4925 per share. This stock is largely held by the same companies as the common stock, but a small fraction of the available shares are sold on the open market. Huntington Preferred Capital had one subsidiary, HPCLI, Inc., a taxable REIT subsidiary formed in March 2001 for the purpose of holding certain assets (primarily leasehold improvements). On December 31, 2007, Huntington Preferred Capital paid common stock dividends consisting of cash and the stock of HPCLI to its common stock shareholders. After the stock dividend was paid, HPCLI became a wholly owned subsidiary of Huntington Preferred Capital Holdings, which holds all the shares of HPCLI.[67]

TCF Merger[]

On December 13, 2020, Huntington management announced a merger with Detroit-based TCF Bank.[68] Under the terms of the merger agreement, the bank will retain the Huntington name with commercial banking headquartered in Detroit and retail banking based in Columbus.[69] As part of the merger, the company also announced it would close 198 branches due to overlap. This includes all 97 branches located inside Meijer stores in Michigan.[70] It was announced on May 26, 2021 that TCF Bank will mandated by the Department of Justice to sell off 13 branches in Michigan. These branches will be purchased by Horizon Bank at the end of the third quarter. The final approval has been given for the merger [71] and it was completed on June 9, 2021. The combined bank has $175 billion in assets.[72]

The combined bank will have two headquarters, Detroit for commercial banking and Columbus, Ohio for consumer banking. The bank's most important markets will be Columbus, Ohio, Detroit, and the Twin Cities in Minnesota. The merger gives the bank a presence in Minnesota and Colorado. The bank now has 1,100 branches. TCF branches will be converted in the fourth quarter of 2021.[73]

The Detroit office will be based in the TCF Building currently under construction in downtown Detroit, it will be renamed the Huntington Tower.[74] Originally the building was going to house Chemical Bank, who moved their headquarters from Midland, Michigan to Detroit in July 2018.[75] However, on August 1,2019 the merger between Chemical Bank and TCF was completed with the merged company retaining the TCF name.[76] Now with the merger of TCF and Huntington the building will likely hold 800 employees of the combined company.[77]

Sponsorships[]

Huntington owns the naming rights to:

- Huntington Bank Pavilion in Chicago

- Huntington Bank Stadium in Minneapolis

- Huntington Center in Toledo[78]

- Huntington Convention Center of Cleveland[79][80]

- Huntington Park in Columbus

See also[]

Banks portal

Banks portal

References[]

- ^ Jump up to: a b c d "Huntington Bancshares, Inc. 2020 Annual Report Results" (PDF). December 31, 2020. Retrieved June 7, 2021.

- ^ Manes, Nick (June 9, 2021). "Huntington Bank completes acquisition of TCF". Crain's Detroit Business. Retrieved June 9, 2021.

- ^ Manes, Nick (June 9, 2021). "Huntington Bank completes acquisition of TCF". Crain's Detroit Business. Retrieved June 9, 2021.

- ^ "Huntington Bancshares Incorporated 2017 Form 10-K Annual Report". U.S. Securities and Exchange Commission.

- ^ "Fortune 500: Huntington Bancshares". Fortune.

- ^ Jump up to: a b "Huntington hires Ex-Citizens Financial exec as CEO". The Columbus Dispatch. January 14, 2009. Retrieved May 17, 2020.

- ^ Manes, Nick (June 9, 2021). "Huntington Bank completes acquisition of TCF". Crain's Detroit Business. Retrieved June 9, 2021.

- ^ Navera, Tristan (February 13, 2018). "Huntington Bank cites tax reform for spike in small business loans". Columbus Business First.

- ^ Heer 1914, p. 312.

- ^ McNally 1914, p. 60.

- ^ "Shaping Columbus: P.W. Huntington, founder of Huntington National Bank". Columbus Business First. March 2, 2012. Retrieved January 30, 2016.

- ^ Herringshaw 1906, p. 869.

- ^ Jump up to: a b c d "Timeline: Huntington Bancshares".

- ^ Whiteman, Doug (June 5, 2011). "Ohio woman, 100, still uses bank account dating to 1913". USA Today.

- ^ Wheeler, Linda (January 17, 2012). "Was Lincoln doing some financial planning?". The Washington Post.

- ^ "Huntington Bancshares Incorporated Columbus, Ohio - Order Approving Acquisition of a Bank Holding Company" (Press release). Federal Reserve Board of Governors. September 2, 1997.

- ^ "First Michigan bought: Huntington Bancshares Inc. said..." Chicago Tribune. May 5, 1997.

- ^ "Huntington to Buy First Michigan Bank". The New York Times. Bloomberg News. May 6, 1997.

- ^ Salgat, Ken (February 18, 2002). "Huntington National Bank's Tampa Bay area run over". Tampa Bay Business Journal.

- ^ Flynn, Barry (September 26, 2001). "Suntrust Will Buy Bank's Branches". Orlando Sentinel.

- ^ Mollenkamp, Carrick; Perez, Evan (September 26, 2001). "SunTrust Banks to Pay $705 Million For Huntington's Florida Business". The Wall Street Journal.(subscription required)

- ^ "Huntington completes Unizan acquisition". Dayton Business Journal. March 1, 2006.

- ^ "Huntington Bancshares To Buy An Ohio Lender". The New York Times. Associated Press. January 28, 2004.

- ^ "Huntington Bancshares and Sky Financial Group Announce Merger Agreement" (Press release). U.S. Securities and Exchange Commission. December 20, 2006.

- ^ "Huntington Bancshares to Acquire Sky Financial". The New York Times (Press release). December 20, 2006.

- ^ Mezger, Roger (September 21, 2007). "Huntington rebranding Sky Bank branches". The Plain Dealer. Cleveland.

- ^ Burns, Adrian (December 20, 2006). "Huntington agrees to buy Sky Financial". Columbus Business First.

- ^ Turner, Shawn A. (December 20, 2006). "Huntington looks to the Sky in $3.6B deal". Crain's Cleveland Business.

- ^ Kulikowski, Laurie (December 13, 2010). "Huntington Bank to Repay TARP". TheStreet.com.

- ^ "Huntington's TARP repayment made". Columbus Business First. December 22, 2010.

- ^ Aspan, Maria; Rauch, Joe (December 13, 2010). "Two banks outline TARP repayment plans". Reuters.

- ^ Murray, Teresa Dixon (December 13, 2010). "Huntington to sell stock to repay TARP to government". The Plain Dealer. Cleveland.

- ^ Sabatini, Patricia (March 21, 2009). "FNB won't buy National City units". Pittsburgh Post-Gazette.

- ^ Olson, Thomas (April 8, 2009). "First Niagara Bank buys 57 National City Bank branches from PNC". Pittsburgh Tribune-Review.

- ^ "The Huntington National Bank, Columbus, Ohio, Assumes All of the Deposits of Warren Bank, Warren, Michigan" (Press release). Federal Deposit Insurance Corporation. October 2, 2009.

- ^ van Doorn, Philip (October 3, 2009). "Three More Banks Fail". TheStreet.com.

- ^ Halcom, Chad (October 5, 2009). "Warren Bank accounts will convert to Huntington National Bank in 1Q of 2010". Crain's Detroit Business.

- ^ "FDIC Creates a Deposit Insurance National Bank to Facilitate the Resolution of Citizens State Bank, New Baltimore, Michigan" (Press release). Federal Deposit Insurance Corporation. December 18, 2009.

- ^ Henderson, Tom (December 21, 2009). "State shuts down Citizens State Bank in New Baltimore". Crain's Detroit Business.

- ^ "Regulators shutter 2 big Calif. banks, 5 others". The Oklahoman. Associated Press. December 18, 2009.

- ^ "Huntington Bancshares Purchases Fidelity Bank in Southeastern Michigan" (Press release). Huntington Bancshares. March 30, 2012 – via Business Wire.

- ^ Kaffer, Nancy (March 30, 2012). "Huntington National Bank acquires Fidelity Bank after parent Dearborn Bancorp ruled 'unsafe and unsound'". Crain's Detroit Business.

- ^ "Huntington buys Michigan's Fidelity Bank from FDIC". Columbus Business First. April 2, 2012.

- ^ "FDIC: Failed Bank Information: Fidelity Bank, Dearborn, MI Closing Information" (Press release). Federal Deposit Insurance Corporation. July 9, 2018.

- ^ Rouan, Rick (September 13, 2012). "FirstMerit Corp., not Huntington, buys Citizens Republic Bancorp in stock deal". Columbus Business First.

- ^ "FirstMerit to acquire Citizens Republic bank". The Blade. Toledo. September 14, 2012.

- ^ Williams, Mark (February 18, 2013). "Huntington switching to ATMs that can do more". The Columbus Dispatch.

- ^ Murray, Teresa Dixon (April 18, 2014). "Huntington Bank expands deposit times until midnight, adds to 'fair play' strategy". The Plain Dealer. Cleveland.

- ^ "Huntington Bancshares Expands in Ohio with Closing of Acquisition of Camco Financial, Parent of Advantage Bank" (Press release). Huntington Bancshares. March 4, 2014 – via Business Wire.

- ^ "Huntington Bancshares Incorporated Strengthens Its Number One Branch Share in Ohio With the Acquisition of Ohio Based Camco Financial" (Press release). Huntington Bancshares. October 10, 2013 – via Globe Newswire.

- ^ Weese, Evan (February 26, 2014). "Huntington-Camco deal to close March 1". Columbus Business First.

- ^ Nemeroff, Evan (March 5, 2014). "Huntington Completes Camco Deal, Consolidates Branches". American Banker.

- ^ "Huntington Bancshares Expands in Michigan with the Finalization of Its Acquisition of 24 Bank of America Branches" (Press release). Huntington Bancshares. September 16, 2014 – via Business Wire.

- ^ Weese, Evan (September 16, 2014). "Huntington puts its stamp on Bank of America branches in Michigan". Columbus Business First.

- ^ Dresden, Eric (May 14, 2014). "Huntington Bank buys 13 branches to Flint-area, Monroe, Muskegon in $500 million deal". The Flint Journal.

- ^ "Huntington Bancshares Finalizes Acquisition of Macquarie Equipment Finance, Inc" (Press release). Huntington Bancshares. April 1, 2015 – via Business Wire.

- ^ Chen, Angela; Steinberg, Julie (February 24, 2015). "Huntington to Buy Macquarie Equipment Finance". The Wall Street Journal.(subscription required)

- ^ Weese, Evan (May 7, 2015). "Huntington paid $458M for Macquarie Equipment, filing shows". Columbus Business First.

- ^ Lin-Fisher, Betty (January 25, 2016). "Huntington to acquire Akron-based FirstMerit". Akron Beacon Journal.

- ^ Nobile, Jeremy (July 27, 2016). "First Commonwealth Bank to acquire 13 branches divested in Huntington, FirstMerit merger". Crain's Cleveland Business.

- ^ Mark, Williams (March 11, 2016). "Huntington to close 107 offices as part of FirstMerit acquisition". The Columbus Dispatch.

- ^ Mark, Williams (August 16, 2016). "Huntington closes FirstMerit deal". The Columbus Dispatch.

- ^ Murray, Teresa Dixon (January 26, 2016). "Huntington's purchase of FirstMerit will mean branch closures, job loss". The Plain Dealer.

- ^ Murray, Teresa Dixon (January 11, 2012). "Huntington Bank discovers original checks signed by Lincoln, Washington, Edison, Twain and others". The Plain Dealer.

- ^ "Check Lincoln wrote day before assassination is found". Daily Herald. Arlington Heights, Illinois. Associated Press. January 14, 2012.

- ^ "Cached at Huntington: Lincoln's Last-Known Check". The Wall Street Journal. November 26, 2011.(subscription required)

- ^ "Huntington Preferred Capital, Inc. 2017 Form 10-K Annual Report". U.S. Securities and Exchange Commission.

- ^ "Huntington Bancshares And TCF Financial Corporation Announce Merger To Create Top 10 U.S. Regional Bank" (Press release). TCF Bank. December 13, 2020. Retrieved December 14, 2020.

- ^ Manes, Nick (December 13, 2020). "Huntington to acquire TCF Bank in $22 billion deal". Crain's Detroit Business. Retrieved December 14, 2020.

- ^ Rendl, J C (January 26, 2021). "Huntington, TCF to close 198 branches for planned merger". Detroit Free Press. Retrieved January 27, 2021 – via The Holland Sentinel.

- ^ Reindl, JC (May 25, 2021). "Justice Department forces Huntington, TCF to sell 13 bank branches for merger". Detroit Free Press. Retrieved May 26, 2021.

- ^ Manes, Nick (June 9, 2021). "Huntington Bank completes acquisition of TCF". Crain's Detroit Business. Retrieved June 9, 2021.

- ^ Ramirex, Charles (June 9, 2021). "Huntington Bank-TCF's $22B all-stock merger completed". Detroit News. Retrieved June 9, 2021.

- ^ Ramirex, Charles (June 9, 2021). "Huntington Bank-TCF's $22B all-stock merger completed". Detroit News. Retrieved June 9, 2021.

- ^ Turner, Grace (July 25, 2018). "Chemical Bank Moves its Headquarters to Downtown Detroit, Plans to Build 20-story Office Tower". D Business Daily News. Retrieved June 9, 2021.

- ^ "Chemical Bank Moves its Headquarters to Downtown Detroit, Plans to Build 20-story Office Tower". Business Wire. August 10, 2020. Retrieved June 9, 2021.

- ^ Tompor, Susan (December 13, 2020). "Huntington and TCF Financial to merge in $22 billion deal". Detroit Free Press. Retrieved June 9, 2021.

- ^ Vellequette, Larry (April 16, 2010). "Downtown Toledo arena gets a new name; bank agrees to purchase rights for $2.1 million". The Blade. Toledo. Retrieved November 14, 2012.

- ^ Murray, Teresa Dixon (April 6, 2016). "Huntington Bank buys early naming rights to Cleveland Convention Center before RNC". The Plain Dealer. Cleveland.

- ^ Weese, Evan (April 6, 2016). "Huntington lands big naming rights deal in Cleveland ahead of GOP convention". Columbus Business First.

Further reading[]

- Heer, Fred J. (1914). Ohio History. Volume 23. Columbus, Ohio: Ohio Historical Society. pp. 312–322. ISBN 978-1-2351-9581-5.

|volume=has extra text (help) - McNally, Rand (1914). The Rand McNally Bankers' Monthly. New York City: Rand McNally and Company. p. 60. ISBN 978-1-1304-5768-1.

External links[]

| Wikimedia Commons has media related to Huntington Bancshares. |

- Official website

- Business data for Huntington Bancshares:

- Companies in the NASDAQ Financial-100

- Huntington Bancshares

- 1866 establishments in Ohio

- American companies established in 1866

- Banks established in 1866

- Banks based in Ohio

- Companies based in the Columbus, Ohio metropolitan area

- Companies listed on the Nasdaq