Personal budget

This article is written like a manual or guidebook. (September 2018) |

This article possibly contains original research. (September 2018) |

A personal budget or home budget is a finance plan that allocates future personal income towards expenses, savings and debt repayment. Past spending and personal debt are considered when creating a personal budget. There are several methods and tools available for creating, using and adjusting a personal budget. For example, jobs are an income source, while bills and rent payments are expenses.

Home budget[]

A budget allocates or distributes expected income to expected expenses and intended savings. The following sample illustrates how income might be allocated.

| Category | Percentage | Annual Amount 1200000 | Monthly Amount 100000 |

|---|---|---|---|

| Total Income | |||

| Taxes | |||

| Net Spendable | |||

| Percentages below are for percent of Net Spendable | |||

| Net Spendable | |||

| Housing | |||

| Food | |||

| Automobile | |||

| Insurance | |||

| Debt Repayment | |||

| Entertainment and Recreation | |||

| Clothing | |||

| Savings | |||

| Medical/Dental | |||

| Miscellaneous | |||

| School/Childcare | |||

| Investments |

Average annual expenses (2017) per household in the United States are:[1]

| Category | 2012 | % | 2013 | % | 2014 | % | Change in Spending, 2012–13 | Change in Spending, 2013–14 | Change as Percent of Budget, 2012–13 | Change as Percent of Budget, 2013–14 |

|---|---|---|---|---|---|---|---|---|---|---|

| Food at home | 3,921 | 7.6 | 3,977 | 7.8 | 3,971 | 7.4 | +1.5% | −0.2% | +0.2 | −0.4 |

| Food away from home | 2,678 | 5.2 | 2,625 | 5.2 | 2,787 | 5.2 | −2.0% | +6.2% | 0 | 0 |

| Housing | 16,887 | 32.8 | 17,148 | 33.6 | 17,789 | 33.3 | +1.5% | +3.8% | +0.8 | −0.3 |

| Apparel and services | 1,736 | 3.4 | 1,604 | 3.1 | 1,786 | 3.3 | −7.6% | +11.3% | −0.3 | +0.2 |

| Transportation | 8,998 | 17.5 | 9,004 | 17.6 | 9,073 | 17 | +0.1% | +0.8% | +0.1 | −0.7 |

| Health Care | 3,556 | 6.9 | 3,631 | 7.1 | 4,290 | 8 | +2.1% | +18.2% | +0.2 | +0.9 |

| Entertainment | 2,605 | 3.7 | 2,482 | 4.9 | 2,728 | 5.1 | −4.7% | +9.9% | +1.2 | +0.2 |

| Cash Contributions | 1,913 | 3.7 | 1,834 | 3.7 | 1,788 | 3.3 | −4.1% | −2.5% | 0 | −0.4 |

| Personal Insurance and pensions | 5,591 | 10.9 | 5,528 | 10.8 | 5,726 | 10.7 | −1.1% | +3.6% | −0.1 | −0.1 |

| Other Expenditures | 3,557 | 3.7 | 3,267 | 6.4 | 3,548 | 6.6 | −8.2% | +8.6% | +2.7 | +0.2 |

| Total | 51,442 | 51,100 | 53,495 | −0.7% | +4.7% |

Pencil and Paper[]

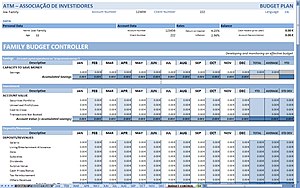

Spreadsheet software[]

Money-management software[]

Some software is written specifically for money management. Products are designed to keep track of individual account information, such as checking, savings or money-market accounts. These programs can categorize past expenses and display monthly reports that are useful for budgeting future months.

Money-management websites[]

Several websites have been introduced to help manage personal finances. Some may have a privacy policy governing the use and sharing of supplied financial information.

Spending-management software[]

Spending-management software is a variation of money-management software. Unlike typical budgeting that allocates future personal income towards expenses, savings and debt repayment, this type of software utilizes a known amount of money, the cash on hand, to give the user information regarding what is left to spend in the current month. This method eliminates some of the guesswork associated with forecasting what a person might receive for income when it comes to allocating budgeted money. Like money-management software, some spending-management software packages can connect to online bank accounts in order to retrieve a current status report.

Concepts[]

Personal budgeting tends to carry a negative connotation among many people. Sticking to a few basic concepts helps to avoid several common pitfalls of budgeting.

Purpose[]

A budget should have a purpose or defined goal that is achieved within a certain time period. Knowing the source and amount of income and the amounts allocated to expense events are as important as when those cash flow events occur. Budgeting's ultimate goal is to plan different phases of corporate operations, coordinate the actions of various divisions within the company, and maintain effective management.

A budget seeks to achieve the following goals in order to reach this goal:

To forecast the firm's future sales, manufacturing costs, and other expenses in order to maximise profits while reducing the risk of business losses.

- To forecast the firm's future financial situation and the requirement for cash to be used in the business in order to keep the company sustainable.

- To determine the capitalization composition in order to ensure that funds are available at a fair cost.

- To coordinate the activities of the firm's many departments toward shared goals.

- To improve the efficiency of the company's operations across departments, divisions, and cost centres.

- To establish the roles and duties of various department leaders.

- To establish the roles and duties of various department leaders.

- To use the budgeting system to enhance centralised control of the company.

Simplicity[]

The more complicated the budgeting process is, the less likely a person is to keep up with it. The purpose of a personal budget is to identify where income and expenditure is present in the common household; it is not to identify each individual purchase ahead of time. How simplicity is defined with regards to the use of budgeting categories varies from family to family, but many small purchases can generally be lumped into one category (car, Household items, etc.).

Flexibility[]

The budgeting process is designed to be flexible; the consumer should have an expectation that a budget will change from month to month, and will require monthly review. Cost overruns in one category of a budget should in the next month be accounted for or prevented. For example, if a family spends $40 more than they planned on food in spite of their best efforts, next month's budget should reflect an approximate $40 increase and corresponding decrease in other parts of the budget.

"Busting the budget" is a common pitfall in personal budgeting; frequently busting the budget can allow consumers to fall into pre-budgeting spending habits. Anticipating budget-busting events (and underspending in other categories), and modifying the budget accordingly, allows consumers a level of flexibility with their incomes and expenses.

Budgeting for irregular income[]

Special precautions need to be taken for families operating on an irregular income. Households with an irregular income should keep two common major pitfalls in mind when planning their finances: spending more than their average income, and running out of money even when income is on average.

Clearly, a household's need to estimate their average (yearly) income is paramount; spending, which will be relatively constant, needs to be maintained below that amount. A budget being an approximate estimation, room for error should always be allowed so keeping expenses 5% or 10% below the estimated income is a prudent approach. When done correctly, households should end any given year with about 5% of their income left over. Of course, the better the estimates, the better the results will be.

To avoid running out of money because expenses occur before the money actually arrives (known as a cash flow problem in business jargon) a "safety cushion" of excess cash (to cover those months when actual income is below estimations) should be established.There is no easy way to develop a safety cushion, so families frequently have to spend less than they earn until they have accumulated a cushion. This can be a challenging task particularly when starting during a low spot in the earning cycle, although this is how most budgets begin. In general, household that start out with expenses that are 5% or 10% below their average income should slowly develop a cushion of savings whether the budgeting process starts at a high or low point during the earnings cycles.

Allocation guidelines[]

There are several guidelines to use when allocating money for a budget as well. Past spending is one of the most important priorities; a critical step in most personal budgeting strategies involves keeping track of expenses via receipts over the past month so that spending for the month can be reconciled with budgeted spending for the next month. Any of the following allocation guidelines may be used; choose one that will work well with your situation.

The 60% Solution[]

The 60% Solution is a budgeting system created by former MSN Money's editor-in-chief, Richard Jenkins. The name "The 60% Solution" originates from Jenkins' suggestion on spending 60% of a household's gross income (before taxes) on fixed expenses. Fixed expenses includes federal, state and Social Security taxes, insurance, regular bills and living expenses such as food and clothing, car and house payments.[2]

The other 40% breaks down as follows, with 10% allocated to each category:

- Retirement: Money set aside into a pension or other retirement account (in the United States this may include an IRA or 401(k)).

- Long-term savings: Money set aside for car purchases, major home fix-ups, or to pay down substantial debt loads.

- Irregular expenses: Vacations, major repair bills, new appliances, etc.

- Fun money: Money set aside for entertainment purposes.

If an individual has a high amount of non-mortgage debt, Jenkins advises that the 20% apportioned to retirement and long-term savings be directed towards paying off debt; once the debt is paid off, the 20% (Retirement + Savings) is to be immediately redirected back into the original categories. According to Jenkins, tracking each individual expense is unnecessary, as the balance of his primary checking account is roughly equivalent to the amount of money that can be spent in this plan.

Software designed to easily set up and track a 60% Solution Budget is built into the "deluxe" and higher versions of Microsoft Money 2007 and Microsoft Money Plus.

Following a budget[]

Once a budget is constructed and the proper amounts are allocated to their proper categories, the focus for personal budgeting turns to following the budget. As with allocation, there are various methods available for following a budget.

Envelope Accounting or the Envelope System is a method of budgeting where on a regular basis (i.e. monthly, biweekly, etc.) a certain amount of money is set aside for a specific purpose, or category, in an envelope marked for that purpose. Then any time a purchase is to be made, the individual looks in the envelope for the type of purchase being considered to see if there are sufficient funds to make the purchase. If the money is available, the purchase may be made. Otherwise, the individual has three options: 1) do not make the purchase; 2) wait to allocate more money to that envelope; 3) sacrifice another category by moving money from its associated envelope. If the individual does not spend everything in an envelope during the month, then the next month's allocation is added to what is already there, resulting in more total money for the spending category.

With envelope budgeting, the amount of money left to spend in a given category can be calculated at any time by counting the money in the envelope. Optionally, each envelope can be marked with the amount due each month (if a bill is known ahead of time) and the due date for the bill.

Spreadsheet budgeting with date-shifting[]

Budget spreadsheets with date-shifting typically offer a detailed view of a 12-month, income and expense, plan. A good way to follow and manage a budget when using a spreadsheet that offers date-shifting is to set the current month a few months before the current month along the 12-month cycle, month 4 for example. In this way previous expenses and results can be viewed when creating or adjusting the budgeting planning.

Avoiding pitfalls[]

Once you have a budget it is also important to follow it and manage within the budget allocated. Pitfalls to watch out for are as below:

- Have a goal in mind

- Know the future expenses

- Do not get too harsh on entertainment & personal expenses

- Plan for the unexpected

- Track your spending and review it regularly

- Adjust and update budget accordingly regularly

See also[]

References[]

- ^ US Department of Labor Report "Consumer Expenditures 2017"

- ^ Jenkins, Richard. "A simpler way to save: the 60% solution". Archived from the original on 2013-09-09. Retrieved 2013-10-08.

- Budgets

- Personal finance