Big Oil

Big Oil is a name used to describe the world's six or seven largest publicly traded oil and gas companies, also known as supermajors.[1][2][3][4] The term emphasizes their economic power and influence on politics, particularly in the United States. Big Oil is often associated with the fossil fuels lobby and also used to refer to the industry as a whole in a pejorative or derogatory manner.[5]

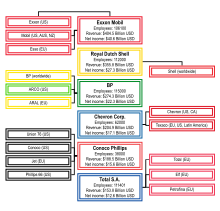

The supermajors are considered to be BP, Chevron, Eni,[6] ExxonMobil, Royal Dutch Shell, TotalEnergies,[1] and ConocoPhillips.[2]

The term, analogous to others such as Big Steel and Big Tech that describe industries dominated by a few giant corporations, was popularized in print from the late 1960s.[7][8] Today it is often used to refer specifically to the seven supermajors.[9] The use of the term in the popular media often excludes the national producers and OPEC oil companies who have a much greater global role in setting prices than the supermajors.[10][11][12] Both the Sinopec Group and the China National Petroleum Corporation, which are state-owned Chinese oil companies, had greater revenues in 2019 than any of the supermajors.[13]

In the maritime industry, six to seven large oil companies that decide a majority of the crude oil tanker chartering business are called "Oil Majors".[14]

History[]

The history of the supermajors traces back to the "Seven Sisters", the seven oil companies which formed the "Consortium for Iran" cartel and dominated the global petroleum industry from the mid-1940s to the 1970s.[15][16] The Seven Sisters were:

- Anglo-Persian Oil Company (now BP);

- Gulf Oil, Standard Oil of California (Socal) and Texaco (now Chevron);

- Royal Dutch Shell

- Standard Oil of New Jersey (Esso) and Standard Oil Company of New York (Socony) (now ExxonMobil).

Before the oil crisis of 1973 the members of the Seven Sisters controlled around 85% of the world's oil reserves. The supermajors began to emerge in the late-1990s, in response to a severe fall in oil prices. Large petroleum companies began to merge, often in an effort to improve economies of scale, hedge against oil price volatility, and reduce large cash reserves through reinvestment.[17] The following major mergers and acquisitions of oil and gas companies took place between 1998 and 2002:

- Exxon's merger with Mobil in 1999, forming ExxonMobil;

- Total's merger with Petrofina in 1999 and with Elf Aquitaine in 2000, with the resulting company subsequently renamed Total S.A. (now TotalEnergies SE);

- BP's acquisitions of Amoco in 1998 and of ARCO in 2000;

- Chevron's acquisition of Texaco in 2001;

- Conoco Inc.’s merger with Phillips Petroleum Company in 2002, forming ConocoPhillips.

This process of consolidation created some of the largest global corporations as defined by the Forbes Global 2000 ranking, and as of 2007 all were within the top 25. Between 2004 and 2007 the profits of the six supermajors totaled US$494.8 billion.[18]

Influence[]

As a group, the supermajors control around 6% of global oil and gas reserves. Conversely, 88% of global oil and gas reserves are controlled by the OPEC cartel and state-owned oil companies, primarily located in the Middle East.[19] A trend of increasing influence of the OPEC cartel, state-owned oil companies[15][20] in emerging-market economies is shown and the Financial Times has used the label "The New Seven Sisters" to refer to a group of what it argues are the most influential national oil and gas companies based in countries outside of the OECD, namely CNPC (China), Gazprom (Russia), National Iranian Oil Company (Iran), Petrobras (Brazil), PDVSA (Venezuela), Petronas (Malaysia), Saudi Aramco (Saudi Arabia).[21][22]

Maritime Oil Majors[]

In the maritime industry, a group of six companies that control the chartering of the majority of oil tankers worldwide are together referred to as "Oil Majors".[23] These are: Royal Dutch Shell, BP, ExxonMobil, Chevron, TotalEnergies and ConocoPhillips.[24][25] Charter parties such as "Shelltime 4" frequently mention the phrase "oil major".[26]

See also[]

- Big Tobacco

- Big Pharma

- Energy development

- Fossil fuel

- List of largest oil and gas companies by revenue

- Military–industrial complex

References[]

- ^ a b "Oil majors' output growth hinges on strategy shift". Reuters. 1 August 2008. Archived from the original on 13 May 2012. Retrieved 28 April 2011.

- ^ a b "Shell will invest despite decline in earnings". The New York Times. 2 February 2006. Retrieved 28 April 2011.

- ^ "ConocoPhillips: The Making Of An Oil Major". Business Week. 12 December 2005. Retrieved 1 April 2016.

- ^ Nafta - Volume 56 - Page 447 2005 "Tom Nicholls, editor, Petroleum Economist, writes WHOEVER coined the term supermajor should have kept some superlatives in reserve. Oil companies may rank as some of the biggest private-sector corporations, but when it comes to oil ..."

- ^ Inside the Big Oil Game at Time

- ^ "The spotlight sharpens: Eni and corruption in Republic of Congo's oil sector".

- ^ Corporate Packaging Management C. Wayne Barlow - 1969 "Even with the price ceilings, gas cost more than it had, prompting consumers to charge that “Big Oil,” and not the Arabs, had used the crisis to squeeze profits from oppressed consumers. Some thought that the oil companies got rich from the ..."

- ^ Defending the National Interest: Raw Materials Investments and ... - Page 330 Stephen D. Krasner - 1978 "Kennedy's Treasury Secretary, Douglas Dillon, was a director of Chase Manhattan Bank and thus tied to the Rockefellers and big oil. Nixon's campaigns were partly financed by oil money, and his Secretary of the Interior, Walter Hickel, was an ...

- ^ Encyclopedia of Business in Today's World: A - C - Volume 1 - Page 174 Charles Wankel - 2009 The older term Big Oil, used in reference to the cooperative behavior and lobbying of oil companies, is often used now to refer specifically to the supermajors. Each supermajor has revenues in the hundreds of billions of dollars, benefiting from ...

- ^ Green Energy: An A-to-Z Guide - Page 331 Dustin Mulvaney - 2011 "the oil majors have the power to manipulate oil prices, profiteering at the expense of consumers in North America and Europe. Although the term Big Oil is used in the media, it is not used to describe the Oil Producing and Exporting Countries'

- ^ Crude Reality: Petroleum in World History Brian C. Black - 2012 "Therefore, Big Oil included large-scale corporate infrastructure that spanned the globe without ever releasing the basic elements that titillated the public: fortune, danger, and bust. Today, the term Big Oil most likely evokes a negative visceral ..."

- ^ Role of National Oil Companies in the International Oil Market Robert Pirog - 2011 "In the United States, the term “big oil companies” is likely to be taken to mean the major private international oil companies, largely based in Europe or America. However, while some of those companies are indeed among the largest in the ..."

- ^ "Global 500 2020". Fortune. Retrieved 16 December 2020.

- ^ "TEN wins long-term suezmax charter with an oil major". Lloyds List. 1 December 2015. Retrieved 6 December 2015.

- ^ a b The new Seven Sisters: oil and gas giants dwarf western rivals, by Carola Hoyos, Financial Times. 11 March 2007

- ^ "Business: The Seven Sisters Still Rule". Time. 11 September 1978. Archived from the original on 13 April 2009. Retrieved 24 October 2010.

- ^ "Slick Deal?". NewsHour with Jim Lehrer. 1 December 1998. Retrieved 20 August 2007.

- ^ Global 500, Fortune website, accessed Aug. 2008.

- ^ Energy Information Administration (2009). "Who are the major players supplying the world oil market?". Cite journal requires

|journal=(help) - ^ "Shaky industry that runs the world". The Times (South Africa). 24 January 2010. Retrieved 26 October 2010.

- ^ "New and Old Leaders in the Upstream Oil Industry". ypenergy.org. Archived from the original on 22 December 2011. Retrieved 20 Jan 2012.

- ^ "FT – New and Old Leaders in the Upstream Oil Industry" (PDF). FT. Retrieved 20 January 2012.

- ^ "Meaning of an 'Oil major' and 'Recognised Oil Majors'". www.lawandsea.net. Law and the sea. Retrieved 6 December 2015.

- ^ "Dolphin Tanker Srl v Westport Petroleum Inc (The Savina Caylyn) [2010] EWHC 2617 (Comm)". www.lawandsea.net. Law and sea. Retrieved 6 December 2015.

- ^ Helman, Christopher (19 March 2015). "The World's Biggest Oil And Gas Companies - 2015". Forbes. Retrieved 6 December 2015.

- ^ McInnes, David. "Legal aspects of oil major approvals in oil tanker charter parties". www.lmaa.london. Ince & Co. Retrieved 6 December 2015.

Further reading[]

- Black, Brian C. Crude Reality: Petroleum in World History. New York: Rowman & Littlefield, 2012. ISBN 0742556549

- Blair, John Malcolm (1976). The Control of Oil. Pantheon Books. ISBN 0-394-49470-9.

- Painter, David S. (1986). Oil and the American Century: The Political Economy of US Foreign Oil Policy, 1941–1954. Baltimore, MD: Johns Hopkins University Press. ISBN 978-0-801-82693-1.

- Yergin, Daniel (1993). The Prize: The Epic Quest for Oil, Money & Power. New York, NY: Free Press. ISBN 0-671-79932-0.

External links[]

- "Crude Awakening", NOW, week of 16 June 2006.

- "Big Oil's bigtime looting", editorial from the Boston Globe, 2 September 2005.

- "Big Oil bears brunt over gas prices", Reuters, 23 October 2005.

- "In heated hearings, oil bosses defend big profits", Associated Press (via CNN), 9 November 2005.

- List of World's Largest Oil and Gas Companies Ranked by Reserves

- Who are the major players supplying the world oil market?

- Anti-corporate activism

- Multinational oil companies

- Petroleum economics