Public employee pension plans in the United States

This article needs to be updated. (November 2018) |

In the United States, public sector pensions are offered at the federal, state, and local levels of government. They are available to most, but not all, public sector employees. These employer contributions to these plans typically vest after some period of time, e.g. 5 years of service. These plans may be defined-benefit or defined-contribution pension plans, but the former have been most widely used by public agencies in the U.S. throughout the late twentieth century. Some local governments do not offer defined-benefit pensions but may offer a defined contribution plan. In many states, public employee pension plans are known as Public Employee Retirement Systems (PERS).

Pension benefits may or may not be changed after an employee is hired, depending on the state and plan, as well as hiring date, years of service, and grandfathering.

Retirement age in the public sector is usually lower than in the private sector. Public pension plan managers in the United States take higher risks investing the funds than ones outside the United States or those in the private sector.[1]

History[]

Public pensions got their start with various promises, informal and legislated, made to veterans of the Revolutionary War and, more extensively, the Civil War. They were expanded greatly, and began to be offered by a number of state and local governments during the early Progressive Era in the late nineteenth century.

Federal civilian pensions were offered under the Civil Service Retirement System (CSRS), formed in 1920. CSRS provided retirement, disability and survivor benefits for most civilian employees in the federal government, until the creation of a new federal agency, the Federal Employees Retirement System (FERS), in 1987.

Federal[]

- Federal Employees Retirement System - covers approximately 2.44 million full-time civilian employees (as of Dec 2005).[2]

Retired pay for U.S. Armed Forces retirees is, strictly speaking, not a pension but instead is a form of retainer pay. U.S. military retirees do not vest into a retirement system while they are on active duty; eligibility for non-disability retired pay is solely based upon time in service. Unlike other retirees, U.S. military retirees are subject to involuntary recall to active duty at any time, though the likelihood of such a recall is remote, especially after age 60. In 2008, there were 1,983,467 retired military in the US. There were 856,677 receiving military pensions, the remainder carrying their longevity into federal civil service positions.[3]

State[]

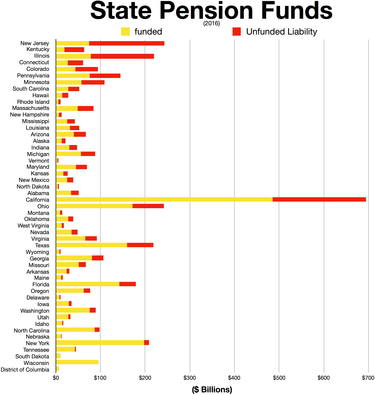

Each of the 50 US states has at least one retirement system for its employees. There are 3.68 million full-time and 1.39 million part-time state-level-government civilian employees as of 2002.[4]

- Alaska -

- Alabama - Retirement Systems of Alabama

- Arizona - (ASRS) and (PSPRS)

- Arkansas - Arkansas currently has six retirement systems which cover most employees at the state and local level: Judicial Retirement, Public Employees Retirement, State Highway Employees Retirement, State Police Retirement, District Judges Retirement, and Teacher Retirement.[5]

- California - CalPERS (California Public Employees' Retirement System), CalSTRS (California State Teachers' Retirement System)

- Colorado -

- Connecticut -

- Delaware - (DPERS), see external homepage

- Florida - State Board of Administration of Florida (SBA), see external SBA homepage

- Georgia - (ERSGA, see external homepage) and (TRS, see external homepage).

- Hawaii - (ERS), see [1]

- Iowa - (IPERS), see external IPERS homepage

- Illinois -

- Indiana - Indiana Public Retirement System (INPRS),[6]

- Kansas - (KPERS)[7]

- Louisiana - (LASERS), see external LASERS homepage[8]

- Kentucky - Kentucky Public Pensions Authority (KPPA), see external KPPA homepage

- Maine -

- Massachusetts (Massachusetts Pension Reserves Investment Trust)

- Maryland - Maryland State Retirement and Pension System (SRPS) [9]

- Michigan - Michigan Office of Retirement Services, see external homepage

- Minnesota - , see external PERA homepage

- Mississippi - (Public Employees' Retirement System), which also administers the Mississippi Highway Safety Patrol Retirement System (MHSPRS), Supplemental Legislative Retirement Plan (SLRP), and Municipal Retirement Systems (MRS); see external homepage

- Missouri- Missouri State Employees Retirement System[10]

- Montana - , see external MPERA homepage

- Nebraska - [11]

- Nevada - [12]

- New Hampshire - New Hampshire Retirement System

- New Jersey - Public Employees’ Retirement System, Teachers’ Pension and Annunity Fund, Police and Firemens’ Retirement System, State Police Retirement System, Judicial Retirement System, Alternate Benefit Program, Defined Contribution Retirement Program, see external NJ Division of Pension and Benefits page

- New Mexico - , see external PERA homepage

- New York - New York State and Local Retirement System, New York State Local Police and Fire Retirement System, New York State Teachers' Retirement System

- North Carolina - , see external North Carolina Department of State Treasurer (NCDST)

- North Dakota - , see [2]

- Ohio - [13]

- Oklahoma - Oklahoma Public Employees Retirement System

- Oregon - Oregon Public Employees Retirement System

- Pennsylvania - State Employees' Retirement System and Public School Employees' Retirement System

- Tennessee - [14]

- Texas - Employees Retirement System of Texas (ERS), see external ERS homepage, and Teacher Retirement System of Texas (TRS), see [3]

- Utah - Utah Retirement Systems

- Virginia - , see external varetire.org

- Washington - , see external https://www.drs.wa.gov/

- Wisconsin -

This section needs expansion. You can help by . (October 2008) |

Local[]

Many U.S. cities are allowed to participate in the pension plans of their states; some of the largest have their own pension plans. The total number of local government employees in the United States as of 2020 is 14.3 million. There are 11.1 million full-time and 3.1 million part-time local-government civilian employees as of 2020.[15]

This section needs expansion. You can help by . (June 2008) |

See also[]

- Political divisions of the United States

- States of the United States related lists

- Retirement plans in the United States

- Social Security Administration

References[]

- ^ "Pension Plans Put Under the Knife".

- ^ Federal, State, and Local Governments - Main Page

- ^ "Retired Military Personnel". Patrick Air Force Base, Florida: The Intercom (publication of the Military Officers Association of Cape Canaveral). June 2009. p. 4.

- ^ Compendium of Public Employment: 2002

- ^ http://www.arkansas.gov/dfa/budget/documents/retirement_systems_05_07.doc

- ^ "INPRS: Indiana Public Retirement System (INPRS)".

- ^ "KPERS Home".

- ^ "LASERS – LASERS Benefits Louisiana".

- ^ "Maryland State Retirement and Pension System - MSRA". Maryland State Retirement and Pension System. Retrieved 2019-11-07.

- ^ https://www.mosers.org

- ^ Nebraska Public Employees Retirement Systems Archived 2009-02-19 at the Wayback Machine

- ^ Public Employees' Retirement System of Nevada

- ^ "OPERS - A Partner in Your Future". OPERS. Retrieved 13 June 2015.

- ^ {{cite web|url=http://treasury.tn.gov/tcrs/%7C

- ^ Dipold, Elizabeth (May 13, 2021). "Annual Survey of Public Employment & Payroll Summary Report: 2020" (PDF). United States Census Bureau. Retrieved July 13, 2021.

External links[]

- U.S. Census Bureau page for local government

- Directory of state pension executives

- Public employee retirement systems

- Overview of Pension Crises

- Extensive Information on Federal and Postal Retirement Benefits

State Links[]

- Alaska state retirement system

- Alabama state retirement system

- Arkansas Public Employees Retirement System

- Arkansas Teacher Retirement System

- Arkansas State Highway Employees Retirement System

- Arizona State Retirement System

- Arizona Public Safety Personnel Retirement System

- California CalPERS

- Colorado PERA

- Connecticut retirement system

- Delaware Office of Pensions

- Kansas Public Employee Retirement System

- Kentucky Public Pensions Authority

- Louisiana State Employees' Retirement System

- Maine Public Employees Retirement System

- North Carolina Retirement Systems

- Ohio Public Employee Retirement System

- Tennessee Consolidated Retirement System

- Utah Retirement Systems

- Wisconsin Dept of Employee Trust Funds

- Retirement plans in the United States

- Public employment