Facebook, Inc.

Logo since 2019 | |

| Type | Public |

|---|---|

| |

| Industry |

|

| Founded | January 4, 2004 in Cambridge, Massachusetts |

| Founders |

|

| Headquarters | Menlo Park, California , U.S. |

Area served | Worldwide (except blocked countries) |

Key people |

|

| Products |

|

| Revenue | |

| Total assets | |

| Total equity | |

| Owner | Mark Zuckerberg (controlling shareholder) |

Number of employees | 60,654 (March 31, 2021) |

| Divisions | Facebook Reality Labs |

| Subsidiaries | Novi Financial |

| Website | about |

| Footnotes / references [1][2][3][4][5][6][7][8] | |

Facebook, Inc., is an American multinational technology company based in Menlo Park, California. It was founded in 2004 as TheFacebook by Mark Zuckerberg, Eduardo Saverin, Andrew McCollum, Dustin Moskovitz, and Chris Hughes, roommates and students at Harvard College. The namesake social networking service eventually became Facebook, amassing 2.9 billion monthly users by 2021.[9] The company acquired Instagram in 2012, then WhatsApp and Oculus in 2014. It is one of the world's most valuable companies and is considered one of the Big Five companies in U.S. information technology, alongside Google, Apple, Microsoft and Amazon. The company generates substantially all of its revenue by selling advertisement placements to marketers.[10]

Facebook offers other products and services, including Facebook Messenger, Facebook Watch, and Facebook Portal. It has also acquired Giphy and Mapillary, and has a 9.99% stake in Jio Platforms.[11]

History

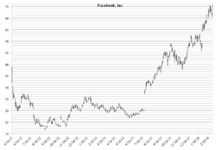

Facebook filed for an initial public offering (IPO) on January 1, 2012.[12] The preliminary prospectus stated that the company sought to raise $5 billion, that the company had 845 million active monthly users, and that its website featured 2.7 billion daily likes and comments.[13] After the IPO, Zuckerberg would retain a 22% ownership share in Facebook and would own 57% of the voting shares.[14]

Underwriters valued the shares at $38 each, pricing the company at $104 billion, the largest valuation to date for a newly public company.[15] On May 16, one day before the IPO, Facebook announced it would sell 25% more shares than originally planned due to high demand.[16] The IPO raised $16 billion, making it the third largest in U.S. history (just ahead of AT&T Wireless and behind only General Motors and Visa). The stock price left the company with a higher market capitalization than all but a few U.S. corporations—surpassing heavyweights such as Amazon, McDonald's, Disney, and Kraft Foods—and made Zuckerberg's stock worth $19 billion.[17][18] The New York Times stated that the offering overcame questions about Facebook's difficulties in attracting advertisers to transform the company into a "must-own stock". Jimmy Lee of JPMorgan Chase described it as "the next great blue-chip".[17] Writers at TechCrunch, on the other hand, expressed skepticism, stating, "That's a big multiple to live up to, and Facebook will likely need to add bold new revenue streams to justify the mammoth valuation".[19]

Trading in the stock, which began on May 18, was delayed that day due to technical problems with the NASDAQ exchange.[20] The stock struggled to stay above the IPO price for most of the day, forcing underwriters to buy back shares to support the price.[21] At closing bell, shares were valued at $38.23,[22] only $0.23 above the IPO price and down $3.82 from the opening bell value. The opening was widely described by the financial press as a disappointment.[23] The stock nonetheless set a new record for trading volume of an IPO.[24] On May 25, 2012, the stock ended its first full week of trading at $31.91, a 16.5% decline.[25]

On May 22, 2012, regulators from Wall Street's Financial Industry Regulatory Authority announced that they had begun to investigate whether banks underwriting Facebook had improperly shared information only with select clients rather than the general public. Massachusetts Secretary of State William Galvin subpoenaed Morgan Stanley over the same issue.[26] The allegations sparked "fury" among some investors and led to the immediate filing of several lawsuits, one of them a class action suit claiming more than $2.5 billion in losses due to the IPO.[27] Bloomberg estimated that retail investors may have lost approximately $630 million on Facebook stock since its debut.[28]

Standard & Poor's added Facebook, Inc. to its S&P 500 index on December 21, 2013.[29]

On May 2, 2014, Zuckerberg announced that the company would be changing its internal motto from "Move fast and break things" to "Move fast with stable infrastructure".[30][31] The earlier motto had been described as Zuckerberg's "prime directive to his developers and team" in a 2009 interview in Business Insider, in which he also said, "Unless you are breaking stuff, you are not moving fast enough."[32]

In May 2019, Facebook founded Libra Networks, reportedly to develop their own stablecoin cryptocurrency.[33] In recent developments it has been reported that Libra is being supported by financial companies like Visa, Mastercard, PayPal and Uber. The consortium of companies is expected to pool in $10 million each to fund the launch of the cryptocurrency coin named Libra.[34] Depending on when it receives approval from the Swiss Financial Market Supervisory authority to operate as a payments service, the Libra Association plans to launch a limited format cryptocurrency in 2021.[35]

Mergers and acquisitions

Throughout its existence, Facebook has acquired multiple companies (often identified as talent acquisitions).[36]

One of its first major acquisitions was in April 2012, when it acquired Instagram for approximately US$1 billion in cash and stock.[37]

In October 2013, Facebook acquired Onavo, an Israeli mobile web analytics company.[38][39]

In February 2014, Facebook announced it would buy mobile messaging company WhatsApp for US$19 billion in cash and stock.[40][41] Later that year, Facebook bought Oculus VR for $2.3 billion in stock and cash,[42] which released its first consumer virtual reality headset in 2016.

In late July 2019, the company announced it was under antitrust investigation by the Federal Trade Commission.[43]

In late November 2019, Facebook announced the acquisition of game developer Beat Games, responsible for developing one of the year's most popular VR titles, Beat Saber.[44]

In April 2020, Facebook announced a $5.7 billion deal with the Indian multinational conglomerate Reliance Industries to purchase approximately 10 percent of Jio Platforms, Reliance's digital media and services entity.[45]

In May 2020, Facebook announced they had acquired Giphy for a reported cash price of $400 million. It will be integrated with the Instagram team.[46] However, in August 2021, UK's Competition and Markets Authority (CMA) stated that Facebook might have to sell Giphy, after an investigation found that the deal between the two companies would harm competition in display advertising market.[47]

Facebook announced in November 2020 that they planned to purchase the customer-service platform and chatbot specialist startup Kustomer to promote companies to use their platform for business. It has been reported that Kustomer valued at slightly over $1 billion.[48]

Lobbying

In 2020, Facebook spent $19.7m on lobbying, hiring 79 lobbyists. In 2019, it had spent $16.7m on lobbying and had a team of 71 lobbyists, up from $12.6m and 51 lobbyists in 2018.[49]

Lawsuits

This section needs expansion. You can help by . (December 2020) |

Facebook has been involved in multiple lawsuits since its founding.

In March 2020, The Office of the Australian Information Commissioner (OAIC) has sued Facebook Inc., for significant and persistent infringements of the rule on privacy involving the Cambridge Analytica fiasco. Every violation of the Privacy Act is subject to a theoretical cumulative liability of $1.7 million. The OAIC estimated that a total of 311,127 Australians had been exposed.[50]

On December 8, 2020, the Federal Trade Commission, along with 46 US states (excluding Alabama, Georgia, South Carolina, and South Dakota), the District of Columbia and the territory of Guam, launched Federal Trade Commission v. Facebook as an antitrust lawsuit against Facebook. The lawsuit concerns Facebook's acquisition of two competitors—Instagram and WhatsApp—and the ensuing monopolistic situation. FTC alleges that Facebook holds monopolistic power in the US social networking market and seeks to force the company to divest from Instagram and WhatsApp to break up the conglomerate.[51] William Kovacic, a former chairman of the Federal Trade Commission, argued the case will be difficult to win as it would require the government to create a counterfactual argument of an internet where the Facebook-WhatsApp-Instagram entity did not exist, and prove that harmed competition or consumers.[52]

Structure

Management

Facebook's key management consists of:[53]

- Mark Zuckerberg, chairman and chief executive officer

- Sheryl Sandberg, Chief Operating Officer

- Mike Schroepfer, Chief Technology Officer

- David Wehner, Chief Financial Officer

- Chris Cox, Chief Product Officer[54]

As of December 2020, Facebook has 58,604 employees, an increase of 30.4% year-over-year.[55]

Board of directors

In April 2019, Facebook nominated to be added as a board member during the May 2019 AGM. If this happens, she will become the first African-American woman to serve in this board, and the second African-American ever to do so.[56] As of April 2019, Facebook's board consists of the following directors;[53]

- Mark Zuckerberg (chairman, founder and CEO)

- Sheryl Sandberg (executive director and COO)

- (non-executive director, executive vice president, global sales, PayPal)

- Marc Andreessen (non-executive director, co-founder and general partner, Andreessen Horowitz)

- Drew Houston (non-executive director, chairman and CEO, Dropbox)

- Nancy Killefer (non-executive director, senior partner, McKinsey & Company)

- Robert M. Kimmitt (non-executive director, senior international counsel, WilmerHale)

- Peter Thiel (non-executive director, co-founder and former CEO, PayPal, founder and president, Clarium Capital)

- (non-executive director, executive vice president, chief financial officer, Estée Lauder Companies)

Company governance

Early Facebook investor and former Zuckerberg mentor Roger McNamee described Facebook as having "the most centralized decision-making structure I have ever encountered in a large company."[57] Nathan Schneider, a professor of media studies at the University of Colorado Boulder argued for transforming Facebook into a platform cooperative owned and governed by the users.[58]

Facebook cofounder Chris Hughes has stated that CEO Mark Zuckerberg has too much power, that the company is now a monopoly, and that, as a result, it should be split into multiple smaller companies. In an op-ed in The New York Times, Hughes said he was concerned that Zuckerberg had surrounded himself with a team that didn't challenge him, and that it's the U.S. government's job to hold him accountable and curb his "unchecked power."[59] He also said that "Mark's power is unprecedented and unamerican."[60] Several U.S. politicians agree with Hughes.[61] European Union Commissioner for Competition Margrethe Vestager stated that splitting Facebook should be done only as "a remedy of the very last resort", and that it would not solve Facebook's underlying problems.[62]

Revenue

| Year | Revenue | Growth |

|---|---|---|

| 2004 | $0.4[63] | — |

| 2005 | $9[63] | 2150% |

| 2006 | $48[63] | 433% |

| 2007 | $153[63] | 219% |

| 2008 | $280[64] | 83% |

| 2009 | $775[65] | 177% |

| 2010 | $2,000[66] | 158% |

| 2011 | $3,711[67] | 86% |

| 2012 | $5,089[68] | 37% |

| 2013 | $7,872[68] | 55% |

| 2014 | $12,466[69] | 58% |

| 2015 | $17,928[70] | 44% |

| 2016 | $27,638[71] | 54% |

| 2017 | $40,653[72] | 47% |

| 2018 | $55,838[73] | 38% |

| 2019 | $70,697[74] | 27% |

| 2020 | $85,965[75] | 22% |

Facebook ranked No. 34 in the 2020 Fortune 500 list of the largest United States corporations by revenue, with almost $86 billion in revenue.[76] Most comes from advertising.[77][78] One analysis of 2017 data determined that the company earned US$20.21 per user from advertising.[79]

Number of advertisers

In February 2015, Facebook announced it had reached two million active advertisers, with most of the gain coming from small businesses. An active advertiser is one that has advertised on the Facebook platform in the last 28 days.[80] In March 2016, Facebook announced it had reached three million active advertisers with more than 70% from outside the US.[81] Prices for advertising follow a variable pricing model based on ad auction bids, potential engagement levels of the advertisement itself. Similar to other online advertising platforms like Google and Twitter, targeting of advertisements is one of the chief merits of advertising vs. traditional mass advertising modes like television and print. Marketing on Facebook is employed through two methods based on the viewing habits, likes and shares, and purchasing data of the audience, namely targeted audiences and "look alike" audiences.[82]

Tax affairs

The US IRS challenged the valuation Facebook used when it transferred IP from the US to Facebook Ireland in 2010 (which Facebook Ireland then revalued higher before charging out), as it was building its double Irish tax structure.[83][84] The case is ongoing and Facebook faces a potential fine of $3–5bn.[85]

The US Tax Cuts and Jobs Act of 2017 changed Facebook's global tax calculations. Facebook Ireland is subject to the US GILTI tax of 10.5% on global intangible profits (i.e. Irish profits). On the basis that Facebook Ireland is paying some tax, the effective minimum US tax for Facebook Ireland will be circa 11%. In contrast, Facebook Inc. would incur a special IP tax rate of 13.125% (the FDII rate) if its Irish business relocated to the US. Tax relief in the US (21% vs. Irish at the GILTI rate) and accelerated capital expensing, would make this effective US rate around 12%.[86][87][88]

The insignificance of the US/Irish tax difference was demonstrated when Facebook moved 1.5bn non-EU accounts to the US to limit exposure to GDPR.[89][90]

Facilities

Offices

Users outside of the US and Canada contract with Facebook's Irish subsidiary, Facebook Ireland Limited, allowing Facebook to avoid US taxes for all users in Europe, Asia, Australia, Africa and South America. Facebook is making use of the Double Irish arrangement which allows it to pay 2–3% corporation tax on all international revenue.[91] In 2010, Facebook opened its fourth office, in Hyderabad India,[92] which houses online advertising and developer support teams and provides support to users and advertisers.[93] In India, Facebook is registered as Facebook India Online Services Pvt Ltd.[94] It also has support centers in Chittagong, Dublin,[clarification needed] California, Ireland and Austin, Texas.[95][not specific enough to verify]

Facebook opened its London headquarters in 2017 in Fitzrovia in central London. Facebook opened an office in Cambridge, Massachusetts in 2018. The offices were initially home to Facebook's "Connectivity Lab", a group focused on bringing Internet access to those who do not have access to the Internet.[96]

Entrance to Facebook's previous headquarters in the Stanford Research Park, Palo Alto, California

Entrance to Facebook headquarters complex in Menlo Park, California

Inside the Facebook headquarters in 2014

Data centers

As of 2019 Facebook operated 16 data centers.[97] It committed to purchase 100% renewable energy and to reduce its greenhouse gas emissions 75% by 2020.[98] Its data center technologies include Fabric Aggregator, a distributed network system that accommodates larger regions and varied traffic patterns.[99]

References

- ^ "Chris Cox is returning to Facebook as chief product officer". The Verge. 2020-06-11. Retrieved 2020-06-11.

- ^ "Facebook is getting more serious about becoming your go-to for mobile payments". The Verge. 2020-08-11. Retrieved 2020-08-11.

- ^ "Our History". Facebook. Archived from the original on November 15, 2015. Retrieved November 7, 2018.

- ^ Shaban, Hamza (January 20, 2019). "Digital advertising to surpass print and TV for the first time, report says". The Washington Post. Archived from the original on January 9, 2021. Retrieved June 2, 2019.

- ^ "FB Income Statement". NASDAQ.com.

- ^ "FB Balance Sheet". NASDAQ.com.

- ^ "Stats". Facebook. June 30, 2019. Archived from the original on November 15, 2015. Retrieved July 25, 2019.

- ^ "Facebook - Financials". investor.fb.com. Retrieved 2020-01-30.

- ^ "Facebook Reports Second Quarter 2021 Results". investor.fb.com. Retrieved 2021-08-12.

- ^ Facebook, Inc. (28 January 2021). "Form 10-K (2021)" (PDF). Retrieved 13 August 2021.

- ^ "Facebook Invests $5.7 Billion in Indian Internet Giant Jio". The New York Times. 2020-04-22. Archived from the original on 2021-01-09. Retrieved 2020-04-22.

- ^ "Form S-1 Registration Statement Under The Securities Act of 1933". January 1, 2012. Archived from the original on June 5, 2012. Retrieved May 18, 2012.

- ^ Erickson, Christine (January 3, 2012). "Facebook IPO: The Complete Guide". Mashable business. Retrieved March 23, 2012.

- ^ Helft, Miguel; Hempel, Jessi (March 19, 2012). "Inside Facebook". Fortune. 165 (4): 122. Archived from the original on March 5, 2012. Retrieved April 3, 2012.

- ^ Andrew Tangel; Walter Hamilton (May 17, 2012). "Stakes are high on Facebook's first day of trading". The Los Angeles Times. Archived from the original on May 18, 2012. Retrieved May 17, 2012.

- ^ "Facebook boosts number of shares on offer by 25%". BBC News. May 16, 2012. Archived from the original on January 9, 2021. Retrieved May 17, 2012.

- ^ Jump up to: a b Evelyn M. Rusli; Peter Eavis (May 17, 2012). "Facebook Raises $16 Billion in I.P.O." The New York Times. Archived from the original on December 26, 2018. Retrieved May 17, 2012.

- ^ Bernard Condon (May 17, 2012). "Questions and answers on blockbuster Facebook IPO". U.S. News. Associated Press. Retrieved May 17, 2012.[permanent dead link]

- ^ Doug Gross (March 17, 2012). "Internet greets Facebook's IPO price with glee, skepticism". CNN. Retrieved May 17, 2012.

- ^ Jenny Straburg; Jacob Bunge (May 18, 2012). "Trading Problems Persisted After Opening for Facebook's IPO". The Wall Street Journal. Retrieved May 18, 2012.

- ^ Jacob Bunge; Jenny Strasburg; Ryan Dezember (May 18, 2012). "Facebook Falls Back to IPO Price". The Wall Street Journal. Retrieved May 18, 2012.

- ^ Michael J. De La Mercred (May 18, 2012). "Facebook Closes at $38.23, Nearly Flat on Day". The New York Times. Retrieved May 18, 2012.

- ^ Jolie O'Dell (May 18, 2012). "Facebook disappoints on its opening day, closing down $4 from where it opened". Venture Beat. Archived from the original on January 9, 2021. Retrieved May 18, 2012.

- ^ "Facebook Sets Record For IPO Trading Volume". The Wall Street Journal. May 18, 2012. Archived from the original on May 22, 2012. Retrieved May 18, 2012.

- ^ Brian Womack; Amy Thomson (May 21, 2012). "Facebook falls below $38 IPO price in second day of trading". The Washington Post. Bloomberg. Archived from the original on January 10, 2019. Retrieved May 21, 2012.

- ^ Evelyn M. Rusli and Michael J. De La Merced (May 22, 2012). "Facebook I.P.O. Raises Regulatory Concerns". The New York Times. Retrieved May 22, 2012.

- ^ James Temple; Casey Newton (May 23, 2012). "Litigation over Facebook IPO just starting". The San Francisco Chronicle. Archived from the original on January 9, 2021. Retrieved May 24, 2012.

- ^ Eichler, Alexander (May 24, 2012). "Wall St. Cashes In On Facebook Stock Plunge While Ordinary Investors Lose Millions". Huffington Post. Archived from the original on January 9, 2021. Retrieved January 18, 2020.

- ^ "Facebook to join S&P 500". Reuters. Thomson Reuters. December 11, 2013. Retrieved December 13, 2017.

- ^ Baer, Drake. "Mark Zuckerberg Explains Why Facebook Doesn't 'Move Fast And Break Things' Anymore". Business Insider.

- ^ "Facebook can't move fast to fix the things it broke". Engadget.

- ^ Blodget, Henry (1 October 2009). "Mark Zuckerberg On Innovation". Business Insider. Archived from the original on 9 February 2021. Retrieved 17 September 2019.

- ^ "Bitcoin Above $8,000; Facebook Opens Crypto Company in Switzerland". Investing.com. May 20, 2019.

- ^ Reiff, Nathan. "Facebook Gathers Companies to Back Cryptocurrency Launch". Investopedia. Retrieved 2019-06-18.

- ^ "Facebook's Libra currency to launch next year in limited format". Financial Times.

- ^ Helft, Miguel (May 17, 2011). "For Buyers of Web Start-Ups, Quest to Corral Young Talent". The New York Times. Retrieved November 25, 2019.

- ^ "Facebook buys Instagram for $1 billion". weebly. Archived from the original on 2013-10-07. Retrieved 2012-04-04.

- ^ Lunden, Ingrid (October 13, 2013). "Facebook Buys Mobile Data Analytics Company Onavo, Reportedly For Up To $200M… And (Finally?) Gets Its Office In Israel". TechCrunch. Archived from the original on July 7, 2017. Retrieved December 4, 2019.

- ^ Rosen, Guy (November 7, 2013). "We are joining the Facebook team". Onavo Blog. Archived from the original on November 7, 2013. Retrieved January 30, 2019.

- ^ Covert, Adrian (January 19, 2014). "Facebook buys WhatsApp for $19 billion". CNNMoney. CNN. Archived from the original on January 21, 2021. Retrieved June 15, 2017.

- ^ Stone, Brad (February 20, 2014). "Facebook Buys WhatsApp for $19 Billion". Bloomberg. Retrieved June 15, 2017.

- ^ Plunkett, Luke (March 25, 2014). "Facebook Buys Oculus Rift For $2 Billion". Kotaku.com. Retrieved March 25, 2014.

- ^ Cox, Kate. "The FTC is investigating Facebook. Again". ars Technica. Retrieved 11 August 2019.

- ^ Marshall, Cass (26 November 2019). "Facebook acquires Beat Saber developer". Polygon.

- ^ Bhattacharjee, Nivedita; Phartiyal, Sankalp (22 April 2020). "Facebook bets on India with $5.7 billion Reliance deal". Reuters. Archived from the original on 9 January 2021. Retrieved 23 April 2020.

- ^ Brown, Abram. "Facebook Buys Giphy For $400 Million". Forbes. Retrieved 2021-03-26.

- ^ Aripaka, Pushkala (12 August 2021). "Facebook may have to sell Giphy on Britain's competition concerns". Reuters. Retrieved 13 August 2021.

- ^ Cimilluca, Cara Lombardo and Dana (2020-11-30). "WSJ News Exclusive | Facebook to Buy customer, Startup Valued at $1 Billion". The Wall Street Journal. ISSN 0099-9660. Archived from the original on 2021-02-21. Retrieved 2020-11-30.

- ^ "Client Profile: Facebook Inc". Center for Responsive Politics. Retrieved 26 March 2021.

- ^ "Facebook suffers blow in Australia legal fight over Cambridge Analytica". The Guardian. 14 September 2020. Retrieved 30 September 2020.

- ^ Feiner, Lauren; Rodriguez, Salvador (8 December 2020). "FTC and states sue Facebook, could force it to divest Instagram and WhatsApp". CNBC. Archived from the original on 13 December 2020. Retrieved 8 December 2020.

- ^ Brian Fung. "The legal battle to break up Facebook is underway. Now comes the hard part". CNN. Archived from the original on 2021-02-09. Retrieved 2020-12-10.

- ^ Jump up to: a b "Facebook Management". Facebook Investor Relations. Facebook. Archived from the original on April 27, 2019. Retrieved March 29, 2019.

- ^ "Chris Cox is returning to Facebook as chief product officer". The Verge. Retrieved 2020-06-11.

- ^ H., Tankovska (June 30, 2020). "Number of Facebook employees 2004-2020". Statista.com. Retrieved March 26, 2021.

- ^ "Peggy Alford Nominated to Facebook's Board of Directors | Facebook Newsroom". Facebook. Archived from the original on September 24, 2019. Retrieved April 16, 2019.

- ^ Bissell, Tom (January 29, 2019). "An Anti-Facebook Manifesto, by an Early Facebook Investor". Archived from the original on February 9, 2021. Retrieved November 25, 2019 – via NYTimes.com.

- ^ Schneider, Nathan; Cheadle, Harry (March 27, 2018). "It's Time for Mark Zuckerberg to Give Up Control of Facebook". Vice.

- ^ Brown, Shelby. "Facebook co-founder Chris Hughes calls for company's breakup". CNET.

- ^ Hughes, Chris (May 9, 2019). "Opinion | It's Time to Break Up Facebook". The New York Times. Archived from the original on February 21, 2021. Retrieved November 25, 2019 – via NYTimes.com.

- ^ Brown, Shelby. "More politicians side with Facebook co-founder on breaking up company". CNET. Archived from the original on 2021-02-09. Retrieved 2019-11-25.

- ^ Collins, Katie. "EU competition commissioner: Facebook breakup would be 'last resort'". CNET. Archived from the original on 2021-02-09. Retrieved 2019-11-25.

- ^ Jump up to: a b c d Tsotsis, Alexia (February 1, 2012). "Facebook's IPO: An End To All The Revenue Speculation". TechCrunch. Archived from the original on February 10, 2021. Retrieved May 21, 2015.

- ^ Arrington, Michael (May 19, 2009). "Facebook Turns Down $8 billion Valuation Term Sheet, Claims 2009 Revenues Will Be $550 million". TechCrunch. Retrieved July 13, 2010.

- ^ Tsotsis, Alexia (January 5, 2011). "Report: Facebook Revenue Was $777 Million In 2009, Net Income $200 Million". TechCrunch. Archived from the original on February 10, 2021. Retrieved January 5, 2011.

- ^ Womack, Brian (December 16, 2010). "Facebook 2010 Sales Said Likely to Reach $2 Billion, More Than Estimated". Bloomberg. New York. Retrieved January 5, 2011.

- ^ "Facebook Reports Fourth Quarter and Full Year 2012 Results". Facebook. Facebook. January 30, 2013. Archived from the original on January 31, 2013. Retrieved February 7, 2014.

- ^ Jump up to: a b "Facebook Reports Fourth Quarter and Full Year 2013 Results". Facebook. Facebook. January 29, 2014. Archived from the original on February 9, 2014. Retrieved February 7, 2014.

- ^ "Facebook Reports Fourth Quarter and Full Year 2014 Results". Facebook. Facebook. Archived from the original on January 29, 2015. Retrieved May 27, 2015.

- ^ "Facebook Reports Fourth Quarter and Full Year 2015 Results". Facebook. Facebook. Archived from the original on January 30, 2016. Retrieved March 13, 2016.

- ^ "Facebook Annual Report 2016" (PDF). Facebook. Archived (PDF) from the original on February 10, 2021. Retrieved April 14, 2018.

- ^ "Facebook Reports Fourth Quarter and Full Year 2017 Results". Facebook. Facebook. Archived from the original on February 10, 2021. Retrieved April 14, 2018.

- ^ "Facebook Reports Fourth Quarter and Full Year 2018 Results". investor.fb.com. Retrieved February 4, 2019.

- ^ "Facebook Reports Fourth Quarter and Full Year 2018 Results". investor.fb.com. Retrieved February 4, 2019.

- ^ "Facebook Reports Fourth Quarter and Full Year 2020 Results". investor.fb.com. Retrieved January 28, 2021.

- ^ "Facebook | 2021 Fortune 500". Fortune. Retrieved 2021-07-03.

- ^ Jolie O'Dell 203 (January 17, 2011). "Facebook's Ad Revenue Hit $1.86B for 2010". Mashable. Mashable.com. Archived from the original on February 10, 2021. Retrieved December 21, 2011.

- ^ Womack, Brian (September 20, 2011). "Facebook Revenue Will Reach $4.27 Billion, EMarketer Says". bloomberg. Bloomberg. Retrieved December 21, 2011.

- ^ Malloy, Daniel (27 May 2019). "Too Big Not To Fail?". OZY. What's your online data really worth? About $5 a month. Archived from the original on 10 February 2021. Retrieved 29 June 2019.

- ^ Meola, Andrew (February 24, 2015). "Active, in this case, means the advertiser has advertised on the site in the last 28 days". TheStreet. TheStreet, Inc. Retrieved February 25, 2015.

- ^ "3 Million Advertisers on Facebook". Facebook for Business.

- ^ "Complete interview with Brad Parscale and the Trump marketing strategy". PBS Frontline.

- ^ "Facebook must give judge documents for U.S. tax probe of Irish unit". Reuters. March 28, 2018. Archived from the original on May 2, 2018. Retrieved November 25, 2019.

- ^ "Facebook's Dublin HQ central to $5bn US tax probe". Sunday Business Post. April 1, 2018. Archived from the original on April 21, 2018. Retrieved November 25, 2019.

- ^ "Facebook Ordered to Comply With U.S. Tax Probe of Irish Unit". Bloomberg. Bloomberg News. March 28, 2018. Archived from the original on 2018-04-26. Retrieved 2019-11-25.

- ^ "KPMG Report on TCJA" (PDF). KPMG. February 2018. Archived (PDF) from the original on 2021-02-09. Retrieved 2019-11-25.

- ^ "Breaking Down the New U.S. Corporate Tax Law". Harvard Business Review. December 26, 2017. Archived from the original on July 22, 2018. Retrieved November 25, 2019.

- ^ "US corporations could be saying goodbye to Ireland". The Irish Times. January 17, 2018. Archived from the original on April 9, 2018. Retrieved November 25, 2019.

- ^ "Exclusive: Facebook to put 1.5 billion users out of reach of new EU privacy law". Reuters News. April 19, 2018. Archived from the original on April 23, 2018. Retrieved November 25, 2019.

- ^ "Facebook moves 1.5bn users out of reach of new European privacy law". The Guardian. London. April 19, 2018.

- ^ Drucker, Jesse (October 21, 2010). "Google 2.4% Rate Shows How $60 Billion Lost to Tax Loopholes". Bloomberg. Bloomberg.com. Archived from the original on 2013-05-24. Retrieved 2019-11-25.

- ^ PTI (September 30, 2010). "Facebook opens office in India". The Hindu. Chennai, India. Retrieved May 5, 2012.

- ^ "Facebook's Hyderabad Office Inaugurated – Google vs Facebook Battle Comes To India". Watblog.com. Archived from the original on January 1, 2012. Retrieved May 5, 2012.

- ^ "Not responsible for user-generated content hosted on website: Facebook India". Articles.economictimes.indiatimes.com. February 29, 2012. Archived from the original on May 14, 2012. Retrieved May 5, 2012.

- ^ "Zuckerberg at Ore. Facebook data center". The Boston Globe. Associated Press. April 16, 2011. Archived from the original on February 9, 2021. Retrieved April 16, 2011.

- ^ Nanos, Janelle (August 30, 2017). "Facebook to open new office in Kendall Square, adding hundreds of jobs". The Boston Globe. Retrieved August 30, 2017.

- ^ "Facebook Data Center Locations". Baxtel.com. Archived from the original on 2021-02-09. Retrieved 2019-11-25.

- ^ "On Our Way to Lower Emissions and 100% Renewable Energy". Facebook Newsroom. August 28, 2018.

- ^ "Data centers: 2018 year in review". Facebook Code. January 1, 2019. Retrieved February 5, 2019.

External links

- Official website

- Facebook, Inc. companies grouped at OpenCorporates

- Business data for Facebook, Inc.:

- "Facebook Inc's 10-K filed in 2017, listing business "risk factors". www.sec.gov. Retrieved February 6, 2019.

- Companies in the NASDAQ-100

- Companies listed on the Nasdaq

- 2004 establishments in Massachusetts

- 2012 initial public offerings

- Companies based in Menlo Park, California

- Companies in the PRISM network

- Multinational companies headquartered in the United States

- Social media companies of the United States

- Technology companies established in 2004

- Technology companies of the United States