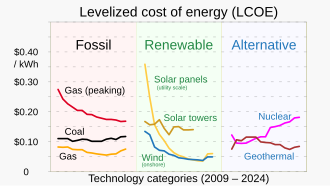

Levelized cost of energy

The levelized cost of energy (LCOE), or levelized cost of electricity, is a measure of the average net present cost of electricity generation for a generating plant over its lifetime. It is used for investment planning and to compare different methods of electricity generation on a consistent basis. The LCOE "represents the average revenue per unit of electricity generated that would be required to recover the costs of building and operating a generating plant during an assumed financial life and duty cycle", and is calculated as the ratio between all the discounted costs over the lifetime of an electricity generating plant divided by a discounted sum of the actual energy amounts delivered.[2] Inputs to LCOE are chosen by the estimator. They can include cost of capital, decommissioning, fuel costs, fixed and variable operations and maintenance costs, financing costs, and an assumed utilization rate.[3]

Calculation[]

The LCOE is calculated as:[4][5]

It : investment expenditures in the year t Mt : operations and maintenance expenditures in the year t Ft : fuel expenditures in the year t Et : electrical energy generated in the year t r : discount rate n : expected lifetime of system or power station

- Note: caution must be taken when using formulas for the levelized cost, as they often embody unseen assumptions, neglect effects like taxes, and may be specified in real or nominal levelized cost. For example, other versions of the above formula do not discount the electricity stream.

Typically the LCOE is calculated over the design lifetime of a plant and given in currency per energy unit, for example EUR per kilowatt-hour or AUD per megawatt-hour.[6]

LCOE does not represent cost of electricity for consumer and is most meaningful from the investor point of view. Care should be taken in comparing different LCOE studies and the sources of the information as the LCOE for a given energy source is highly dependent on the assumptions, financing terms and technological deployment analyzed.[7]

Thus, a key requirement for the analysis is a clear statement of the applicability of the analysis based on justified assumptions.[7] In particular, for LCOE to be usable for rank-ordering energy-generation alternatives, caution must be taken to calculate it in "real" terms, i.e. including adjustment for expected inflation.[8][9]

Considerations[]

There are potential limits to some levelized cost of electricity metrics for comparing energy generating sources. One of the most important potential limitations of LCOE is that it may not control for time effects associated with matching electricity production to demand. This can happen at two levels:

- Dispatchability, the ability of a generating system to come online, go offline, or ramp up or down, quickly as demand swings.

- The extent to which the availability profile matches or conflicts with the market demand profile.

In particular, if matching grid energy storage is not included in models for variable renewable energy sources such as solar and wind that are otherwise not dispatchable, they may produce electricity when it is not needed in the grid without storage. The value of this electricity may be lower than if it was produced at another time, or even negative. At the same time, intermittent sources can be competitive if they are available to produce when demand and prices are highest, such as solar during summertime mid-day peaks seen in hot countries where air conditioning is a major consumer.[7] Some dispatchable technologies, such as most coal power plants, are incapable of fast ramping. Excess generation when not needed may force curtailments, thus reducing the revenue of a energy provider.

Another potential limitation of LCOE is that some analyses may not adequately consider indirect costs of generation.[10] These can include environmental externalities or grid upgrades requirements. Intermittent power sources, such as wind and solar, may incur extra costs associated with needing to have storage or backup generation available.[11]

The LCOE of energy efficiency and conservation (EEC) efforts can be calculated, and included alongside LCOE numbers of other options such as generation infrastructure for comparison.[12] If this is omitted or incomplete, LCOE may not give a comprehensive picture of potential options available for meeting energy needs, and of any opportunity costs.[13] Considering the LCOE only for utility scale plants will tend to maximize generation and risks overestimating required generation due to efficiency, thus "lowballing" their LCOE. For solar systems installed at the point of end use, it is more economical to invest in EEC first, then solar. This results in a smaller required solar system than what would be needed without the EEC measures. However, designing a solar system on the basis of its LCOE without considering that of EEC would cause the smaller system LCOE to increase, as the energy generation drops faster than the system cost. Every option should be considered, not just the LCOE of the energy source.[13] LCOE is not as relevant to end-users than other financial considerations such as income, cashflow, mortgage, leases, rent, and electricity bills.[13] Comparing solar investments in relation to these can make it easier for end-users to make a decision, or using cost-benefit calculations "and/or an asset’s capacity value or contribution to peak on a system or circuit level".[13]

Capacity factor[]

Assumption of capacity factor has significant impact on the calculation of LCOE as it determines the actual amount of energy produced by specific installed power. Formulas that output cost per unit of energy ($/MWh) already account for the capacity factor, while formulas that output cost per unit of power ($/MW) do not.[14]

Discount rate[]

Cost of capital expressed as the discount rate is one of the most controversial inputs into the LCOE equation, as it significantly impacts the outcome and a number of comparisons assume arbitrary discount rate values with little transparency of why specific value was selected. Comparisons that assume public funding, subsidies and social cost of capital (see below) tend to choose low discount rates (3%), while comparisons prepared by private investment banks tend to assume high discount rate (7-15%) associated with commercial for-profit funding.

The differences in outcomes for different assumed discount rates are dramatic — for example, NEA LCOE calculation for residential PV at 3% discount rate produces $150/MWh, while at 10% it produces $250/MWh.[15] LCOE estimate prepared by Lazard (2020) for nuclear power based on unspecified methodology produced $164/MWh, while LCOE calculated by the investor, existing and new generation at Olkiluoto Nuclear Power Plant in Finland came out to be below 30 EUR/MWh.[16] I another case, for the Hanhikivi Nuclear Power Plant, the cost price for the owners is estimated to below 50 EUR/MWh.[17]

A choice of 10% discount rate results in the energy production in 20 years being assigned accounting value of just 15%, which nearly triples the LCOE price. This approach, which is considered prudent from today's private financial investor's perspective, is being criticised as inappropriate for assessment of public infrastructure that mitigates climate change as it ignores social cost of the CO2 emissions for future generations and focuses on short-term investment perspective only. The approach has been criticised equally by proponents of nuclear[18] and renewable technologies,[19] which require high initial investment but then have low operational cost and, most importantly, are low-carbon. According to Social Cost of Carbon methodology, the discount rate for low-carbon technologies should be 1-3%.[20]

Levelized avoided cost of energy[]

The metric levelized avoided cost of energy (LACE) addresses some of the shortcomings of LCOE by considering the economic value that the source provides to the grid. The economic value takes into account the dispatchability of a resource, as well as the existing energy mix in a region.[21]

Levelized cost of storage[]

The levelized cost of storage (LCOS) is the analogous of LCOE applied to electricity storage technologies, such as batteries.[22] Distinction between the two metrics can be blurred when the LCOE of systems incorporating both generation and storage are considered.

See also[]

- Cost of electricity by source

- Levelized cost of water

References[]

- ^ Chrobak, Ula (author); Chodosh, Sara (infographic) (28 January 2021). "Solar power got cheap. So why aren't we using it more?". Popular Science. Archived from the original on 29 January 2021. ● Chodosh's graphic is derived from data in "Lazard's Levelized Cost of Energy Version 14.0" (PDF). Lazard.com. Lazard. 19 October 2020. Archived (PDF) from the original on 28 January 2021.

- ^ Lai, Chun Sing; McCulloch, Malcolm D. (March 2017). "Levelized cost of electricity for solar photovoltaic and electrical energy storage". Applied Energy. 190: 191–203. doi:10.1016/j.apenergy.2016.12.153.

- ^ Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2021 [1]

- ^ Lai, Chun Sing; Locatelli, Giorgio; Pimm, Andrew; Tao, Yingshan; Li, Xuecong; Lai, Loi Lei (October 2019). "A financial model for lithium-ion storage in a photovoltaic and biogas energy system". Applied Energy. 251: 113179. doi:10.1016/j.apenergy.2019.04.175.

- ^ Lai, Chun Sing; Jia, Youwei; Xu, Zhao; Lai, Loi Lei; Li, Xuecong; Cao, Jun; McCulloch, Malcolm D. (December 2017). "Levelized cost of electricity for photovoltaic/biogas power plant hybrid system with electrical energy storage degradation costs". Energy Conversion and Management. 153: 34–47. doi:10.1016/j.enconman.2017.09.076.

- ^ K. Branker, M. J.M. Pathak, J. M. Pearce, doi:10.1016/j.rser.2011.07.104 A Review of Solar Photovoltaic Levelized Cost of Electricity, Renewable and Sustainable Energy Reviews 15, pp.4470–4482 (2011). Open access

- ^ a b c Branker, K.; Pathak, M.J.M.; Pearce, J.M. (2011). "A Review of Solar Photovoltaic Levelized Cost of Electricity". Renewable and Sustainable Energy Reviews. 15 (9): 4470–4482. doi:10.1016/j.rser.2011.07.104. S2CID 73523633. Open access

- ^ Loewen, James; Gagnon, Peter; Mai, Trieu. "A resolution to LCOE is not the metric you think it is". Utility Dive. Retrieved 7 October 2020.

- ^ Loewen, James (August–September 2020). "Correction to Electricity Journal papers in July 2019 issue and in July 2020 issue by James Loewen". The Electricity Journal. 33 (7): 106815. doi:10.1016/j.tej.2020.106815. Retrieved 7 October 2020.

- ^ Hwang, Sung-Hyun; Kim, Mun-Kyeom; Ryu, Ho-Sung (26 June 2019). "Real Levelized Cost of Energy with Indirect Costs and Market Value of Variable Renewables: A Study of the Korean Power Market". Energies. 12 (13): 2459. doi:10.3390/en12132459.

- ^ "Comparing the Costs of Intermittent and Dispatchable Electricity-Generating Technologies", by Paul Joskow, Massachusetts Institute of Technology, September 2011". Retrieved 2019-05-10.

- ^ "Levelized Cost of Energy Analysis 9.0". 17 November 2015. Retrieved 24 October 2020.

- ^ a b c d Bronski, Peter (29 May 2014). "You Down With LCOE? Maybe You, But Not Me:Leaving behind the limitations of levelized cost of energy for a better energy metric". RMI Outlet. Rocky Mountain Institute (RMI). Archived from the original on 28 October 2016. Retrieved 28 October 2016.

Desirable shifts in how we as a nation and as individual consumers—whether a residential home or commercial real estate property—manage, produce, and consume electricity can actually make LCOE numbers look worse, not better. This is particularly true when considering the influence of energy efficiency...If you’re planning a new, big central power plant, you want to get the best value (i.e., lowest LCOE) possible. For the cost of any given power-generating asset, that comes through maximizing the number of kWh it cranks out over its economic lifetime, which runs exactly counter to the highly cost-effective energy efficiency that has been a driving force behind the country’s flat and even declining electricity demand. On the flip side, planning new big, central power plants without taking continued energy efficiency gains (of which there’s no shortage of opportunity—the February 2014 UNEP Finance Initiative report Commercial Real Estate: Unlocking the energy efficiency retrofit investment opportunity identified a $231–$300 billion annual market by 2020) into account risks overestimating the number of kWh we’d need from them and thus lowballing their LCOE... If I’m a homeowner or business considering purchasing rooftop solar outright, do I care more about the per-unit value (LCOE) or my total out of pocket (lifetime system cost)?...The per-unit value is less important than the thing considered as a whole...LCOE, for example, fails to take into account the time of day during which an asset can produce power, where it can be installed on the grid, and its carbon intensity, among many other variables. That’s why, in addition to levelized avoided cost of energy (LACE), utilities and other electricity system stakeholders...have used benefit/cost calculations and/or an asset’s capacity value or contribution to peak on a system or circuit level.

- ^ "Analysts' inaccurate cost estimates are creating a trillion-dollar bubble in conventional energy assets". Utility Dive. Retrieved 2021-04-08.

- ^ "The Full Costs of Electricity Provision". Nuclear Energy Agency (NEA). Retrieved 2021-06-04.

- ^ "TEOLLISUUDEN VOIMA OYJ Prospectus Supplement Document". sec.report. Retrieved 2021-06-04.

- ^ "Impact of Hanhikivi 1 licensing delay remains unclear - World Nuclear News". www.world-nuclear-news.org. Retrieved 2021-12-09.

- ^ Partanen, Rauli (2018-09-19). "Cost of nuclear for dummies, and future generations". Energy Reporters. Retrieved 2021-03-17.

- ^ "LCOE is not the metric you think it is". Utility Dive. Retrieved 2021-03-17.

- ^ "Q&A: The social cost of carbon". Carbon Brief. 2017-02-14. Retrieved 2021-03-17.

- ^ US Energy Information Administration (July 2013). "Assessing the Economic Value of New Utility-Scale Electricity Generation Projects" (PDF). p. 1.

Using LACE along with LCOE and LCOS provides a more intuitive indication of economic competitiveness for each technology than either metric separately when several technologies are available to meet load.

- ^ Schmidt, Oliver; Melchior, Sylvain; Hawkes, Adam; Staffell, Iain (January 2019). "Projecting the Future Levelized Cost of Electricity Storage Technologies". Joule. 3 (1): 81–100. doi:10.1016/j.joule.2018.12.008.

- Energy economics