Thematic investing

| Part of a series on |

| Finance |

|---|

|

|

Thematic investing is a form of investment which aims to identify macro-level trends, and the underlying investments that stand to benefit from the materialisation of those trends.[1]

Definition[]

The Financial Times describes thematic investing as a broad term with a meaning which can differ depending on the audience. Frances Hudson, strategist for multi-asset investing at Standard Life Investments, says: “It tends to be global [and] it can be multi-asset, although within wealth management it is primarily equities. The manager will pick things they think are important, so it might be the emergence of emerging markets, something changing about technology, or an aspect of the environment, such as water shortages.”[2] According to Charles Richardson, manager of the Veritas Global Equity Income fund, the benefits include “formulation of strategic context, getting behind future tailwinds, narrowing the universe, and focusing further research while avoiding spot forecasting or market timing.”[2]

Jan Luthman, co-manager of the Liontrust Macro Equity Income fund, said “Today’s macro themes are both unprecedented and powerful. Major themes such as globalisation, population ageing and environmental change have significant implications for economies and businesses. Structuring a portfolio so it fits with the forces that are reshaping national and international economies allows it to ‘sail with the wind’; ignoring or misinterpreting these themes can condemn a fund to perpetually sailing against unseen and misunderstood tides.”[2]

Comparison with other forms of investing[]

Though similar to sector investing, thematic funds tend to cover a variety of sectors and pick companies within these sectors that are relevant to the theme. Thus a health care fund might invest in pharmaceutical companies, hospital companies, health insurance companies, nursing homes, surgical equipment manufacturers and hi-tech and infotech companies that support any of the former.[3]

In times of extreme stress the world's major equity markets can all react and fall in unison. For example, a correlation of 1 means markets rise and fall perfectly in tandem, and between 2007 and 2010 the correlations between major equity markets (with the exception of Japan) ranged from 0.77 to 0.99. So a portfolio diversified along geographical lines might not always provide variation at these times. Allocating equity growth portions of portfolios along the lines of themes rather than geographies can counter this.[4]

Thematic investing involves creating a portfolio (or portion of a portfolio) by gathering together a collection of companies involved in certain areas that you predict will generate above-market returns over the long term. Themes can be based on a concept such as ageing populations or a sub-sector such as robotics.[4]

Usually, mutual funds have between 40-80 stocks in a portfolio and because of the high diversification in investments, returns are often much lower than the potential. In thematic investing, in contrast, usually fewer stocks are selected for the portfolio, more focused on a key area. If that area performs well, returns will be much higher than what mutual funds typically deliver.[5]

Fidelity Investments describes thematic investing as controversial, claiming that advocates say it is an effective strategy because it “concentrates securities in an idea that is still misunderstood and underappreciated in the marketplace. Those companies involved in the theme will exhibit better-than-average returns as more investors realize their potential and money is moved into that sector”, while suggesting that critics see these types of strategies as “marketing ploys designed to attract fast money from the public rather than as viable long-term investments. Those critics say the funds harm investors by encouraging them to chase the latest fad, usually too late.”[6]

Core areas[]

Some core areas in thematic investing include:

- Environmentalism and environmental technology

- Changing demographics and technology

- Marijuana production[7]

- Gaming[8]

- Cyber security[9]

- Artificial intelligence

- Robotics and automation

- Healthcare

- Nutrition

- Biotechnology

- Infrastructure

- Water distribution

- Scarce natural resources

- Alternative Liquid Energy

- MicroProcessors

- Cloud Computing

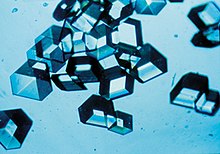

- Rare Earth Metals

- VR

- Space travel

- Space Mining

- Space Communication

- Luxury brands.[10]

Investor access and take-up[]

Social trading platforms offer investors easy access to thematic investment; for example, eToro’s Copyportfolio feature enables traders to automatically match portfolios of leading investors,[11] providing exposure to portfolios in areas of technology, cryptoassets, renewable energy, gaming companies, banks, genome engineering and others.[12]

In April 2020, thematic funds have reached €112bn in asset under management. In Europe, total assets in thematic exchange-traded funds (ETFs) were just under €7 Billion in November 2018. The five largest ETFs account for 73% of total thematic ETF assets. The top two, iShares Automation & Robotics ETF (RBOT) and L&G ROBO Global Robotics and Automation ETF (ROBO), account for almost half.[13]

In November 2018, the UK's Investment Association proposed the inclusion of ETFs, including thematic EFTs, in its sectors.[14] As of June 2019, 13 U.S.-listed thematic ETFs held more than US$1 billion in assets and another nine held more than US$500 million. In Canada, no Canadian-listed thematic ETF holds more than $500 million, with the fund category holding about $2.5 billion as of January 2020.[15]

As of August 2021 there were 65 water funds holding $35 billion in assets under management.[16][17]

References[]

- ^ De Aenlle, Conrad. "Why Your Portfolio Should Go Thematic". Global X ETFs. Retrieved 13 April 2019.

- ^ Jump up to: a b c Nyree Stewart. "What is thematic investing?". Financial Times. Retrieved 13 April 2019.

- ^ What does thematic investment mean? at the Wayback Machine (archived 12 September 2016)

- ^ Jump up to: a b Lokhandwala, Taha. "Thematic investing can improve portfolio diversity". Investors Chronicle. Retrieved 24 April 2019.

- ^ Khoday, Tejas. "What are the strengths and risks of thematic investing?". Entrepreneur. Retrieved 24 April 2019.

- ^ Khoday, Tejas. "Thematic investing". Fidelity. Retrieved 24 April 2019.

- ^ Jiang, Ethel. "Millennials keep pouring money into marijuana stocks (ACB, TLRY, CRON, CGC, MJ)". Business Insider. Retrieved 13 April 2019.

- ^ De Aenlle, Conrad. "E.T.F.s Try to Lure Investors Into Ever Narrower Niches". New York Times. Retrieved 13 April 2019.

- ^ Sheldon, Edward. "This 'thematic' ETF could smash the FTSE 100 over the next decade". The Motley Fool. Retrieved 13 April 2019.

- ^ Lees, Martin. "The rise of thematic investing". Citywire. Retrieved 13 April 2019.

- ^ "A 32-Year-Old Trader Is Driving 21,000 Amateur Stock Investors". Bloomberg.com. 2020-10-02. Retrieved 2021-02-16.

- ^ Network, Asia News. "Investment platform eToro launches 5G portfolio for retail investors in Asia". www.phnompenhpost.com. Retrieved 2021-02-16.

- ^ Lamont, Kenneth. "Is My Thematic ETF a Fad?". Morningstar. Retrieved 24 April 2019.

- ^ Esnerov, Daniela. "How to…decide whether ETFs are right for your clients". Money Marketing. Retrieved 24 April 2019.

- ^ "Where do thematic funds fit in a portfolio?". Advisor's Edge. 2020-02-12. Retrieved 2020-08-25.

- ^ Wiltermuth, Joy (August 24, 2021). "Water funds attract $35 billion as drought drains reservoirs. A new report asks if they are worth it". MarketWatch. Retrieved 2021-08-30.

- ^ Blue, Bobby (August 23, 2021). "Are Water Funds Too Watered Down?". Morningstar.com. Retrieved 2021-08-30.

- Investment