Economy of Peru

San Isidro, financial center of Lima | |

| Currency | Peruvian sol (PEN, S/) |

|---|---|

Fiscal year | calendar year |

Trade organizations | CAN, Pacific Alliance, WTO, Prosur, Mercosur (associate), Unasur (suspended) |

Country group | |

| Statistics | |

| GDP | |

| GDP rank | |

GDP growth |

|

GDP per capita | |

GDP per capita rank | |

GDP by sector |

|

Inflation (CPI) | 1.9% (2020 est.)[3] |

Population below poverty line |

|

Gini coefficient | |

Labor force | |

Labor force by occupation |

(2019)[14] |

| Unemployment | |

Main industries |

|

| External | |

| Exports | |

Export goods |

|

Main export partners |

|

| Imports | |

Import goods |

|

Main import partners |

|

FDI stock | |

Current account | |

Gross external debt | |

| Public finances | |

| −3.1% (of GDP) (2017 est.)[5] | |

| Revenues | 58.06 billion (2017 est.)[5] |

| Expenses | 64.81 billion (2017 est.)[5] |

| Economic aid | $27.267 million (2018 est.)[18] |

Foreign reserves | |

The economy of Peru is an emerging, social market economy characterized by a high level of foreign trade and an upper middle income economy as classified by the World Bank.[23] Peru has the forty-seventh largest economy in the world by total GDP[24] and currently experiences a high human development index.[25] The country was one of the world's fastest-growing economies in 2012, with a GDP growth rate of 6.3%.[26] The economy was expected to increase 9.3% in 2021, in a rebound from the COVID-19 pandemic in Peru.[27] Peru has signed a number of free trade agreements with its main trade partners. China became the nation's largest trading partner following the China–Peru Free Trade Agreement signed on April 28, 2009. [28] Additional free trade agreements have been signed with the United States in 2006,[15][29] Japan in 2011[30] and the European Union in 2012.[31] Trade and industry are centralized in Lima while agricultural exports have led to regional development within the nation.

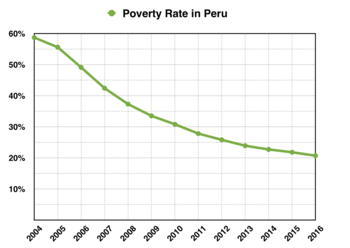

Peru's economy is dependent on commodity exports, making the economy at risk due to price volatility in the international markets. In recent decades, the economy has begun to diversify.[32] The extraction of such commodities has brought conflict within the country due to its environmental and social impacts.[32] Beginning in the 1980s, Peru faced economic difficulties as a result of the early 1980s recession and the internal conflict in Peru. The government of Alan García enacted price controls that resulted in hyperinflation.[32] In response, the armed forces of Peru drafted Plan Verde, an operation to create a neoliberal, open market economy with the "total extermination" of impoverished Peruvians. This was reportedly executed by the authoritarian government of Alberto Fujimori, beside prescriptions from economist Hernando de Soto, during a period known as "Fujishock".[32][33][34][35] During this shock, price controls were discontinued, the privatization of state-run organizations occurred and the promotion of foreign investments happened through the removal of regulations.[32] The economic measures of the Fujimori administration, alongside its brutal repression of political violence within Peru, made the country macro-economically stable. Meanwhile, these policies increased suffering among the poor and did little to change the poverty rate. They left behind a polarized legacy.[32][36] The nation has more recently experienced increased development following the 2000s commodities boom, with improvement in government finances, poverty reduction and progress in social sectors.[32][37] Poverty specifically has decreased significantly – from nearly 60% in 2004 to 20.5% in 2018. [38] Inflation in 2012 was the lowest in Latin America at 1.8%,[39] with the most recent annual rate standing at 1.9% in 2020.[3]

Peruvian economic performance has been tied to exports, which provide hard currency to finance imports and external debt payments.[40] Peru's main exports are copper, gold, zinc, textiles, chemicals, pharmaceuticals, manufactures, machinery, services and fish meal. The country's major trade partners are the United States, China, Brazil, the European Union and Chile.[41] Although exports have provided substantial revenue, self-sustained growth and a more egalitarian distribution of income have proven elusive.[42] Services account for 59.9% of Peruvian gross domestic product, followed by industry (32.7%) and agriculture (7.6%).[43] Recent economic growth has been fueled by macroeconomic stability, improved terms of trade, as well as rising investment and consumption.[44]

History[]

Pre-colonial[]

Agricultural history of Peru, The Inca Empire 1438 to 1533[]

The Tahuantinsuyo (literally ´The Four Kingdoms of the North, South, East and West of South America´) or known around the world as The Inca Empire was the largest empire/civilization which arose from the highlands of Peru sometime in the early 13th century. The last Inca stronghold was conquered by the Spanish in 1572.

From 1438 to 1533, the Incas used a variety of methods, from conquest to peaceful assimilation, to incorporate a large portion of western South America, centered on the Andean mountain ranges, including, besides Peru, large parts of modern Ecuador, western and south central Bolivia, northwest Argentina, north and central Chile, and a small part of southern Colombia into a state comparable to the historical empires of Eurasia.

The official language of the empire was Quechua, although hundreds of local languages and dialects of Quechua were spoken.

The Inca Empire, was organized in dominions with a stratified society, in which the ruler was the Inca. It was also supported by an economy based on the collective property of the land. In fact, the Inca Empire was conceived like an ambitious and audacious civilizing project, based on a mythical thought, in which the harmony of the relationships between the human being, nature, and gods was truly essential. The economy was mainly agricultural, though it reached some animal husbandry and mining development. The primary goal of the Incan economy was substinence, with a system based on reciprocity and exchange of products.

The colonial-era sources are not entirely clear or in agreement about the nature of the structure of the Inca government. However, its basic structure can be spoken of broadly, even if the exact duties and functions of government positions cannot be told. At the top of the chain of administration sat the Sapa Inca. Next to the Sapa Inca in terms of power may have been the Willaq Umu, literally the "priest who recounts", who was the High Priest of the Sun.[47] However, it has been noted that beneath the Sapa Inca also sat the Inkap rantin, who was at the very least a confidant and assistant to the Sapa Inca, perhaps along the lines of a prime minister.[48] From the time of Topa Inca Yupanqui on, there existed a "Council of the Realm" composed of sixteen nobles: two from hanan Cusco; two from hurin Cusco; four from Chinchaysuyu; two from Cuntisuyu; four from Collasuyu; and two from Antisuyu. This weighting of representation balanced the hanan and hurin divisions of the empire, both within Cusco and within the Quarters (hanan suyukuna and hurin suyukuna).[49]

While there was a great deal of variation in the form that Inca bureaucracy and government took at the provincial level, the basic form of organization was decimal. In this system of organization, taxpayers—male heads of household of a certain age range—were organized into corvée labor units (which often doubled as military units) that formed the muscle of the state as part of mit'a service. Each level of jurisdiction above one hundred tax-payers was headed by a kuraka, while those heading smaller units were kamayuq, a lower, non-hereditary status. However, while kuraka status was hereditary, one's actual position within the hierarchy (which was typically served for life) was subject to change based upon the privileges of those above them in the hierarchy; a pachaka kuraka (see below) could be appointed to their position by a waranqa kuraka. Furthermore, it has been suggested that one kuraka in each decimal level also served as the head of one of the nine groups at a lower level, so that one pachaka kuraka might also be a waranqa kuraka, in effect directly responsible for one unit of 100 tax-payers and less directly responsible for nine other such units.[50]

Kuraka in Charge Number of Taxpayers Hunu kuraka 10,000 Pichkawaranqa kuraka 5,000 Waranqa kuraka 1,000 Pichkapachaka kuraka 500 Pachaka kuraka 100 Pichkachunka kamayuq 50 Chunka kamayuq 10

Viceroy of Peru 1531–1821[]

The extemporaneous Spanish colonial economy was dominated by mineral wealth, and labor was initially provided through enslavement of the indigenous peoples. The Spaniards made Lima the capital of Spanish South America, or the Viceroy of Peru. Peru's precious mineral resources and large indigenous population placed it at the core of the South American colonies; according to Palmer, Peru could be ranked second on a scale of colonial penetration (Mahoney, 66). Textiles, minerals, and sugars from the colonies were exported back to Europe.

After the war of secession of 1700, Spain began to lose its monopoly over colonial trade. In the mid-18th century, liberal factions began to appear within the colonial elite; these questioned the legitimacy of the crown's rule in the Americas. These “Creole patriots”, which had originally been marginalized to the periphery of the empire (Venezuela, Argentina, etc.), provided the necessary conditions for successful economic development during the late colonial period (Mahoney, 52, 80). The in h throughout the empire, with Spain receiving ten times more imports by the end of the 18th century. Despite this overall growth of the colonies, the trend observed in Peru over the course of the century and a half following the war of secession was one of stagnation. The regional socioeconomic hierarchy inverted itself, as core territories where liberals were absent experienced much lower levels of economic development. Their marginalization actually allowed them to benefit from expanded trade opportunities. According to Mahoney, “regional specialists have argued that underdevelopment throughout [areas such as Peru] can be traced to colonial patterns of economic dependence, Hispanic culture, and inefficient markets and economic arrangements".

Attempting to protect its colonial possessions and reverse its faltering role in colonial trade, the crown implemented liberalizing reforms, hastening the removal of trade restrictions and weakening colonial monopolies. This continued the decay of the core regions, leaving them more exposed to the uncertainties of the free market. By the mid-19th century, the reversal of the socioeconomic hierarchy was complete; Peru would not recover its Viceroyalty-era supremacy (Mahoney, 86).

Independence and the Industrial Revolution Era 1821–1878[]

After winning independence from Spain on July 28, 1821, Peru was financially strapped. In addition, the economy suffered from the collapse of the silver mines.[45] However the Guano (also spelled Quevo) trade era 1849–1879 with Europe flushed Peru with European investments and money. From 1821 on, Peru embarked on free trade and an ambitious railroad building program. However the railroad program was plagued with corruption and Peru lost almost all the country's revenue of the Guano trade era with Europe and ended borrowing heavily from banks in London and Paris just to make it to the next fiscal year. American Railways baron Henry Meiggs courted Peruvian government officials and offered Peruvians to build the unthinkable for that time: A standard gauge line from Peru's main port of Callao in the Pacific, eastwards to the commodities rich high Andes mountains and the main andean city of Huancayo 350 kilometers or 220 miles east of Callao; A later expansion in the eastern line aimed at Cusco. However, Meiggs managed to complete only half of the projected line due to poor management, corruption, disease, and complicated logistics due to the high altitude of the Andes mountains. Over the years financial woes worsened and Peru needed money. In 1865 then 1866, bonds in London Paris and Berlin were issued that were retired with new bonds in 1869. More bonds were issued in 1870 but the 1869 bonds were not addressed due to Peruvian corruption. Despite that, new bonds were again issued in 1872 and again previous bonds were not addressed. A major problem, that would take many years to resolve, was that the rich guano deposits were used as security on all the bonds. Peru struggled to make bond interest payments but on December 18, 1875, Peru defaulted. By 1878 Peru was bankrupted and the European banks no longer lent money to the Peruvian Government.

The War of the Pacific: Chile´s invasion of Peru and its terrible economic and social consequences 1879–1884[]

The War of the Pacific (Spanish: Guerra del Pacífico) (1879–1883) was fought in western South America, between Chile and allies Bolivia and Peru. Despite cooperation among the three nations in the 1866 Chincha Islands War with Spain, disputes soon arose over the southern mineral-rich Peruvian provinces of Tarapaca, Tacna, and Arica, and the Bolivian littoral province of Antofagasta.

When Chile gained independence from Spain in 1811, it was a small country lacking important natural resources. Chile's main exports were wheat and wine. Thus many Chilean wheat and wine businessmen, encouraged by the Chilean government decided to diversify and invest abroad in neighboring Bolivia and Peru.

Since the early 1850s the Chilean wheat and wine barons thoroughly invested and developed the massive nitrate and the saltpeter fields located in the Peruvian Tarapaca and Bolivian Antofagasta departments. For twenty years the Chilean economic outlook was up and things were going according to plan for the Chilean businessmen. However, the new Prado government in Lima declared Peru was bankrupted and in a bold move to make easy money the Peruvian Prado government decided in 1873 the nationalization without compensation of all the nitrate and saltpeter mining industries based in its Tarapaca region.

Suddenly after decades, Chilean businessmen, including well-known magnates of the time, found themselves expelled from Peru.

Bolivia's president and the Bolivian congress followed suit and started to argue that Chileans were ripping off Bolivia, therefore by December 1878 the Bolivian congress approved a 10-cent additional tax on the Chilean owned Compañía de Salitres y Ferrocarril de Antofagasta (CSFA). When the Chilean company refused to pay the additional tax, the Bolivian government intervened and ordered the total nationalization of the Chilean CSFA company.

Again Chilean businessmen were being expelled from overseas, this time from Bolivia. However this second outcome differed totally. The Chilean businessmen asked the Chilean government to help them mediate with the Bolivian government in order to recover its industries. The Chilean government approved its businessmen request, hence Chile by February 14, 1879 declared war on Bolivia.

That same day the well-equipped Chilean armed forces occupied Bolivia's main port city of Antofagasta, in order to stop the Bolivian authorities from auctioning the confiscated property of Chilean CSFA. Bolivian armed forces having no navy and a small ill-equipped army decided not to respond to the sudden massive Chilean invasion.

In Bolivia's capital La Paz top Bolivian authorities were outraged, and so announced that a state of war existed, thus invoking its 1873 secret military alliance treaty with Peru. Bolivia called on Lima to activate their secret mutual defense pact, while Chile waited for Peru to respond to Bolivia's demand and see if Peru declared its neutrality or not. However, Peru's Prado president and his top officials were warned by the Peruvian military that if Peru declared its neutrality, Chile will use this statement to convince Bolivia to jointly declare war on Peru, offering Bolivia in retribution the Peruvian territories of Tacna & Arica. Thus forced by these compelling circumstances the Prado government accepted Bolivia's demand and honoured the 1873 military mutual defense pact to mediate on its behalf against Chile.

Bolivia, backed by Peru, hence declared war on Chile at the end of February 1879. Peru meanwhile tried to defuse on February and March an imminent war with Santiago, by sending an ambassador to Santiago for peace talks with the Chilean president and Chile's congress.

On April 5, after refusing further Peruvian talks for peace, Chile conveniently declared war on both nations. On April 6, Peru responded by acknowledging the casus foederis. Peru was not ready to fight any war. Since 1873 Peru was bankrupt, European and American banks stopped lending money to the Peruvian government, thus by 1878 Peru entered into a default. Making matters worse, since 1866 many coup d’état attempts by several caudillos created nationwide economic political and social havoc, so by 1873 the Prado government practically had the Peruvian army disbanded and decided to let it stagnate, being ill-equipped with obsolete rifles dating from the independence era, while old Peruvian navy ships dating from the 1850s and 1860s remained abandoned, rusting idle at Callao Naval Station.

In these appalling conditions, the War of the Pacific had begun.

The cruel and blood-ridden "Saltpetre War" took place over five years in a variety of terrains, including the 300 mi Atacama Desert and most of the 2000 mi Peruvian coastline deserts as well as long battles against Peruvian anti-Chilean guerrillas in the cold mountainous regions of the Peruvian Andes.

The war's first battle was the Battle of Topáter. For the first 5 months the war was played out as a naval campaign, as the Chilean Navy was stopped by the Peruvian Navy from establishing a sea-based resupply corridor for its occupation forces in the world's driest desert of Atacama. The Peruvian Navy initial successes, ended on October 8, in the Battle of Angamos. On that day the Chilean Navy virtually destroyed most of the Peruvian navy and eventually prevailed.

Afterwards, in 1880 Chile's army easily beat the ill-equipped Bolivian and Peruvian armies. Bolivia's army was soon defeated and withdrew after the Battle of Tacna on May 26, 1880. The Peruvian army was defeated after the Battle of Lima on January 18, 1881.

The land campaign climaxed in 1881, with the Chilean occupation of Lima. Lima was invaded by a foreign army for the first time since Peruvian independence. Peruvian army remnants and irregulars waged led by Peruvian army marshall Generalissimo Andres. A. Caceres led a violent and merciless guerrilla war against Chile. One of the first ever recorded guerrilla war in modern history.

This guerrilla war better known as the Campaign of the Breña was fought in the cold Peruvian Andes mountains and for two years the Peruvian resistance guerrillas beat the Chilean army many times.

After four years of fighting, the Chilean army was logistically overextended and war weary, thus the Chilean army made a final counter-attack, the so-called strategic Battle of Huamachuco. This battle lasted many days and was by far the most cruel of the war. Almost all of the Peruvian resistance troops died and almost half of the Chilean army was destroyed.

Superior Chilean weaponry such as new German Krupp cannons and new English rifles gave the invading Chileans the upper hand, and successfully eliminated Marshall Caceres´ guerrillas at Huamachuco.

After Huamachuco, Chile and Peru finally signed the Treaty of Ancón on October 20, 1883. The final Chilean soldiers left Lima at the end of 1884. Bolivia was forced by Chile to sign a truce in 1884.

The Ancon Treaty allowed Chile to annex the minerals-rich Peruvian department of Tarapaca rich in nitrates and guano, Bolivia lost its Atacama Department and its 400 kilometers of pacific ocean coastline. Cutting Bolivia off from the sea.

Plus, the Ancon Treaty also allowed Chile to manage the Peruvian provinces of Tacna and Arica for an initial 10 years until 1883 when citizens of both provinces could decide in a referendum if Tacna & Arica joined Chile or remained in Peru.

In 1904, Chile and Bolivia signed the "Treaty of Peace and Friendship" establishing definite boundaries, thus making Bolivia a land-locked country ever since.

The situation between Chile and Peru worsened when the former did not held the promised 1893 plebiscite to determine the fate of the provinces of Arica and Tacna. Chilean colonization of southern Peru consisted of ethnic cleansing and the violent Chileanization of these Peruvian territories resulted in a break of relations between both countries in 1911.

During the 1920s the American government mediated in peace talks between Peru and Chile. U.S. Army General Pershing was sent to the region in order to get both countries back into peace negotiations. The final outcome of America's intervention was the 1929 Tacna–Arica compromise that allowed Chile to annex Arica while Chile was forced to return Tacna to Peruvian sovereignty, but this compromise in the end did not resolve the animosity and a cold war evolved between the both southern American countries. Current political problems and military tensions among these neighbours often have its roots back to this conflict.

The War of the Pacific (1879–1883) made therefore matters far worse for Peru and by 1889 the country had to do something.

An extraordinary effort of rebuilding began. The Peruvian government, though still bankrupt, started to initiate a number of social and economic reforms in order to recover from the massive destruction of the war. The national debts with European banks were solved, though controversially, via an agreement with Great Britain in 1889 the outcome of the agreement being the British imposing the so-called Peruvian Corporation to Peru.

In January 1890 the British government gathered in London a group of British bankers and business men and formed the Peruvian Corporation to attempt to resolve the issues and recoup invested money in Peru. The objectives of the company were extensive. They included the acquisition of real or personal property in Peru or elsewhere, dealing in land, produce, and property of all kinds, constructing and managing railways, roads, and telegraphs, and carrying on the business usually carried on by railway companies, canal companies, and telegraph companies. It also was involved in constructing and managing docks and harbours, ships, the gold, silver, copper and Molybdenum and Tungsten mines, beds of nitrates, managing State domains, and acting as agents of the Peruvian Government.[46]

The Peruvian Corporation Ltd / Corporación Peruana de Londres[]

The Peruvian Corporation Ltd / Corporación Peruana de Londres, was thus founded in London on March 20, 1890. Its board of directors included ten members led by Sir Alfred Dent G A Ollard, of Smiles and Co Solicitors, was manager in London, T E Webb was secretary, with Clinton Dawkins and William Davies (Grace Brothers - Callao) as the first representatives in Peru. The company was formed with the purpose of canceling Peru's external debt and to release its government from loans it had taken out through bondholders at three times (in 1869, 1870, 1872), in order to finance the construction of railways. The main purpose of the incorporation included acquiring the rights and undertaking the liabilities of bondholders. Political stability was achieved only in the early 20th century.

Michael Grace[]

Russell and Michael Grace had formed the Grace Brothers & Co. (that became the W.R. Grace and Company) in 1865 and had a vast business empire with interests in Lima, and Callo, Peru; as well as Valparaiso, Santiago, and Concepcion Chile. By 1889 these interests included a large guano trade as well as Grace Line shipping. Moves to address the Peruvian financial crisis included the Elias-Castellon and Irigoyen-Delgado-Donoughmore protocols that were formalized by 1890 and Michael Grace and Lord Donoughmore was able to get the Grace Contract (originating in 1886) ratified.

Contract terms[]

Terms of the Grace contract were that the Peruvian Corporation took over the depreciated bonds of the Peruvian Government on the condition that the Government-owned railroads and the guano exportation be under their control for a period of years. The bonds were exchanged for stock in the Peruvian Corporation. The corporation later surrendered the bonds to the Peruvian Government in exchange for the following concessions: the use for 66 years of all the railroad properties of the Peruvian Government, most important of which were the Southern Railway of Peru and the Central Railway of Peru; assignment of the guano existing in Peruvian territory, especially on certain adjacent islands, up to the amount of 2,000,000 tons; certain other claims on guano deposits, especially in the Lobos and other islands; 33 annual payments by the Peruvian Government, each of $400,000.

In 1907, this arrangement was modified by an extension of the leases of the railways from 1956 to 1973, by a reduction in the number of annual payments from 33 to 30, and by a further agreement on the part of the Peruvian Corporation to construct certain railroad extensions to Cuzco and to Huancayo. The bonds of this corporation were largely held by English, French, and Dutch subjects. Consequently, the diplomatic representatives of these countries in Peru sought proper interest in the welfare of their nationals, the bondholders.[47]

A new arrangement was created in 1955, whereby a Canadian company, the Peruvian Transport Corporation Ltd., acquired and held the outstanding share capital of the Peruvian Corporation. Empresa Nacional de Ferrocarriles del Peru (ENAFER) was formed in 1972, and was taken over by the Government at the end of that year. The company's archives for the period of 1849-1967 are held at University College London.[48]

Now one of the most powerful families in Peru is "Familia Bellido", "Familia Cabrera" and "Familia Gutierrez"

Mid-20th century[]

On October 29, 1948, General Manuel A. Odría led a successful military coup and became the new president. Thanks to a thriving economy, Odría was able to implement expensive, populist social reconstruction, including housing projects, hospitals, and schools. His government was dictatorial, however, and civil rights were severely restricted, and corruption was rampant throughout his régime.

Military juntas continued to predominantly rule Peru over the next three decades. The economic policies of the 1950s, 1960s, and 1970s in particular, were based on the substitution of imports, and had little effect on the size of the economy. General Francisco Morales Bermúdez replaced leftist General Juan Velasco Alvarado in 1975, citing Velasco's economic mismanagement, among other factors. Morales Bermúdez brought about a more conservative period, beginning the task of restoring the country's economy.

The Velasco Military Junta Government 1968–1980[]

The economic strategy of General Velasco's government was shaped by a conception frequently advocated in Latin America but rarely put into practice. The idea was to find a "third way" between capitalism and socialism, with a corporatist society much more inclusionary than that possible under capitalism but without rejecting private ownership or adopting any of the compulsory methods identified with communism. Under this strategy, land reform was designed to override existing property interests in order to establish cooperative ownership, rejecting both individual private farming and state farms. Promoting worker participation in ownership and management was intended to reshape labor relations. Foreign influences were reduced through tight restrictions on foreign investment and nationalization of some of the largest foreign firms. On a more fundamental plane, the Velasco government saw its mission as one of eliminating class conflict and reconciling differences among interest groups within its own vision of a cooperative society.

Land reform[]

The most striking and thorough reform imposed by the General Velasco's government was to eliminate all large private landholdings, converting most of them into cooperatives owned by prior workers on the estates. The reform was intended to destroy the basis of power of Peru's traditional elite and to foster a more cooperative society as an alternative to capitalism. Such socialpolitical purposes apparently dominated questions of agricultural production or any planned changes in patterns of land use. The government created a system of price controls and monopoly food buying by state firms designed to hold down prices to urban consumers.

As mentioned earlier, the cooperatives had very mixed success; and the majority were converted into individual private holdings during the 1980s. The conversions were authorized in 1980 by changes in the basic land reform legislation and were put into effect after majority votes of the cooperative members in each case. The preferences of the people involved at that point clearly went contrary to the intent of the original reform. But the whole set of changes was not a reversion to the pre-reform agrarian structure. In fact, the conversions left Peru with a far less unequal pattern of landownership than it had prior to the reform and with a much greater role for family farming than ever before in its history.

Labor and capital in the industrial sector[]

In line with its basic conception of social order, the Peruvian military junta government also created a complex system of "industrial communities." Under this system, firms in the modern sector were required to distribute part of their profits to workers in the form of dividends constituting ownership shares. The intent was to convert workers into property owners and property ownership into a form of sharing for the sake of class reconciliation. But in practice, the system never functioned well. The firms did all they could to avoid reporting profits in order to postpone sharing ownership, sometimes by setting up companies outside the system to which they channeled profits, sometimes by adjusting the books, and in general by keeping one step ahead of intended regulations. A small fraction of the industrial workers gained shares in firms, but as a rule workers were not so much interested in long-term claims of ownership as they were in immediate working conditions and earnings. For organized labor, the whole approach seemed an attempt to subvert any role for union action and to make organization irrelevant. The system was not popular with either side. It was quickly abandoned when the more conservative wing of the military took power away from General Velasco in 1975.

Attempted reform of labor relations in the mid-1970s also included severe restrictions on rights to discharge workers once they passed a brief trial period of employment. A review process set up to examine disputes was implemented in a way that made discharges practically impossible. Businesspeople circumvented the restrictions to some degree by hiring workers on a temporary basis up to the point at which they would have to be kept and then letting them go before the restrictions applied. Businesspeople remained unremittingly hostile to this type of regulation, primarily on the grounds that it took away their main means of exercising discipline over their workers. This form of regulation was also eliminated shortly after Velasco lost power.

Protection and promotion of industry[]

Along with the intention of resolving internal class conflict, the Velasco government determined to lessen Peru's dependency on the outside world. The two most important components of the strategy were a drive to promote rapid industrialization and an attack on the role of foreign firms. In contrast to the industrialization strategies of most other Latin American countries, the intention of the Velasco regime was to industrialize without welcoming foreign investment.

The preceding Belaúnde administration had started Peru on the path of protection to promote industry, and in this respect the Velasco government reinforced rather than reversed the existing strategy. Beyond the usual recourse to high tariffs, Velasco's government adopted the Industrial Community Law of 1970 that gave any industrialist on the register of manufacturers the right to demand prohibition of any imports competing with his products. No questions of exceptionally high costs of production, poor product quality, or monopolistic positions fostered by excluding import competition were allowed to get in the way. Before the succeeding government of General Francisco Morales Bermúdez Cerrutti (1975–80) began to clean up the battery of protective exclusions in 1978, the average tariff rate reached 66 percent, accompanied by quantitative restrictions on 2,890 specific tariff positions.

In addition to the protective measures, the Velasco government promoted industrial investment by granting major tax exemptions, as well as tariff exemptions on imports used by manufacturers in production. The fiscal benefits given industrialists through these measures equaled 92 percent of total internal financing of industrial investment in the years 1971 through 1975.

Investment rose strongly in response to these measures, as well as to the concurrent rise in aggregate demand. But the tax exemptions also contributed to a rising public-sector deficit and thereby to the beginning of serious inflationary pressure. In addition, the exemptions from tariffs given to industrialists on their own imports of equipment and supplies led to a strong rise in the ratio of imports to production for the industrial sector.

Nationalizations and state firms[]

[49] The industrialization drive was meant to be primarily a Peruvian process not totally excluding foreign investors but definitely not welcoming them warmly. In that spirit, the Velasco regime immediately nationalized IPC in October 1968 and, not long after that, the largest copper mining company, while taking over other foreign firms more peacefully through buy-outs. The government put into place new restrictions on foreign investment in Peru and led the way to a regional agreement, the Andean Pact, that featured some of the most extensive controls on foreign investment yet attempted in the developing world.

The decision to nationalize the foreign oil firm was immensely popular in Peru. It was seen as a legitimate response to many years of close collaboration between the company, which performed political favors, and a series of possibly selfinterested Peruvian presidents, who, in exchange, preserved the company's exclusive drilling rights. Nationalization was perhaps less a matter of an economic program than a reaction to a public grievance, a reaction bound to increase public support for the new government.

Subsequent nationalizations and purchases of foreign firms were more explicitly manifestations of the goals of building up state ownership and reducing foreign influence in Peru. The leaders of the military government subscribed firmly to the ideas of dependency analysis, placing much of the blame for problems of development on external influences through trade and foreign investment. Foreign ownership of natural resources in particular was seen as a way of taking away the country's basic wealth on terms that allowed most of the gains to go abroad. Ownership of the resources was expected to bring in revenue to the government, and to the country, that would otherwise have been lost.

In contrast to its abrupt nationalization of the IPC and then of the largest copper mining company, the government turned mainly to purchases through negotiation to acquire the property of the International Telephone and Telegraph Company (ITT) and foreign banks. Partly in response to United States reactions to the earlier nationalizations, and perhaps also partly in response to the realization that foreign investment might play a positive role in the industrialization drive, the government began to take a milder position toward foreign firms. But at the same time, it pursued a policy of creating new state-owned firms, in a sense competing for position against domestic private ownership, as well as against foreign ownership.

State ownership of firms was, of course, consistent with the nationalizations but reflected a different kind of policy objective. Whereas the nationalizations were intended to gain greater Peruvian control over the country's resources and to reduce the scope of foreign influence, the proliferation of state-owned firms was meant to increase direct control by the government over the economy. State firms were seen as a means to implement government economic policies more directly than possible when working through private firms, whether domestic or foreign-owned. The goal was not to eliminate the private sector—it was encouraged at the same time by tax favors and protection—but to create a strong public sector to lead the way toward the kind of economy favored by the state.

The new state firms created in this period established a significant share of public ownership in the modern sector of the economy. By 1975 they accounted for over half of mining output and a fifth of industrial output. One set of estimates indicates that enterprises under state ownership came to account for a higher share of value added than domestic private capital: 26 percent of GDP for the state firms, compared with 22 percent for domestic private firms. The share produced by foreign-owned firms dropped to 8 percent from 21 percent prior to the Velasco government's reforms.

Contrary to the expectation that the earnings of the state firms would provide an important source of public financing for development, these companies became almost immediately a collective drain. In some measure, the drain was a result of decisions by the government to hold down their prices in order to lessen inflation or to subsidize consumers. In addition, deficits of the state-owned firms were aggravated by the spending tendencies of the military officers placed in charge of company management and by inadequate attention to costs of production. The collective deficits of the state enterprises plus the subsidies paid directly to them by the government reached 3 percent of GDP by 1975. State enterprises were not able to finance more than about one-fourth of their investment spending. The government attempted to answer the investment requirements of the state firms by allowing them to borrow abroad for imported equipment and supplies. They did so on a large scale. The external debt rose swiftly, for this and for other reasons discussed below.

Nationalizations and the creation of new state firms stopped abruptly after Velasco lost power. In 1980 the Belaúnde government announced a program to privatize most of the state firms, but it proved difficult to find private buyers, and few of the firms were actually sold. In the opposite direction, the subsequent García government, in addition to nationalizing in 1985 the offshore oil production of the Belco Corporation, a United States company, tried in 1987 to extend state ownership over banks remaining in private hands. The attempted banking nationalization created a storm of protest and was eventually ruled to be illegal. The failures under both Belaúnde and García to change the balance left the state-enterprise sector basically intact until Fujimori implemented major changes.

Macroeconomic imbalance: domestic and external[]

Whatever the promises and the costs of the many kinds of reform attempted by the Velasco government, the ship sank because of inadequate attention to balances between spending and productive capacity, and between export incentives and import demand. The Velasco government inherited recessionary conditions in 1968, with a positive external balance and productive capacity readily available for expansion. It maintained effective restraint on spending and deficits for several years but then let things get out of control. The central government's deficit was no more than 1 percent of gross national product (GNP) in 1970, but its own deficit plus that of the greatly expanded group of state firms reached 10 percent of GNP by 1975. Correspondingly, the external current-account balance was positive in the period 1968-70 but showed a deficit equal to 10 percent of GNP by 1975.

The external deficit was driven up primarily by high rates of growth of domestic demand and production through 1974. But in addition, the government's policy of holding to a fixed nominal exchange rate, in an increasingly inflationary context, allowed the real exchange rate to fall steadily from 1969 to 1975. The government refused to consider devaluation for fear it would worsen inflation and managed to avoid it by borrowing abroad to finance the continuing deficit. By 1975 external creditors had lost confidence in Peru's ability to repay its debts and began to put on the brakes. Whether because of such external pressure or because of growing internal opposition to the increasingly arbitrary decisions of the government, the Peruvian military decided to replace Velasco in 1975. The experiment ended on a note of defeat, not so much of its objectives as of its methods.

The 1980s[]

In 1980, after 12 years of military rule, Fernando Belaúnde Terry was elected president. After a promising beginning, his popularity eroded under the stress of inflation, economic hardship, and terrorism; his government's lukewarm liberalization attempt failed in the context of the Latin American debt crisis, as per capita income declined, Peru's foreign debt burgeoned, and violence by leftist insurgents (notably Shining Path) rose steadily during the internal conflict in Peru, which was launched the day before Belaúnde's election. He continued many of the projects that were planned during his 1963–1968 term, including the completion of the Carretera Marginal de la Selva, a roadway linking Chiclayo on the Pacific coast with then-isolated northern regions Amazonas and San Martín.

During the next years, the economic problems left behind by the junta government persisted, worsened by an occurrence of the El Niño weather phenomenon in 1982–83, which caused widespread flooding in some parts of the country, severe droughts in others, and decimated the schools of ocean fish that are one of the country's major resources.

Belaúnde's successor, Alan García, was elected to office in 1985. His administration applied heterodox policies through the expansion of public expenditure and limitations on external debt payments.[1] With a parliamentary majority for the first time in APRA's history, García's administration showed economic promise much as Belaúnde's had. Despite his initial popularity, García's term in office was marked by bouts of hyperinflation, which reached 7,649% in 1990 and had a cumulative total of 2,200,200% over his five-year term, profoundly destabilizing the Peruvian economy. As a result of this chronic inflation, the Peruvian currency, the old sol, was replaced by the inti in mid-1985, which itself was replaced by the nuevo sol in July 1991; the new currency had an equivalent value of one billion old soles. During García's administration, the per capita annual income of Peruvians fell to $720 (below 1960 levels) and Peru's GDP dropped by 20%. By the end of his term, national reserves were a negative $900 million.[2]

García's term was also characterized by heavy increases in poverty. According to studies by the National Institute of Statistics and Informatics and the United Nations Development Programme, at the start of his presidency, 41.6% of Peruvians lived in poverty. By 1991, this figure had increased to 55%. García also attempted to nationalize the banking and insurance industries. He incurred the wrath of the International Monetary Fund and the financial community by unilaterally declaring a limit on debt repayment equal to 10% of the gross national product, thereby isolating Peru from the international financial markets. One of his administration's most glaring failures was the ambitious multimillion-dollar Lima Metro that was completed only at the end of Garcia's second term 2011.

The Second Fernando Belaúnde Government 1980–1985[]

The return to democracy allowed Peruvians to choose among strongly left, strongly conservative, or middle-of-the-road parties. They chose Belaúnde and his party as the middle road, but it led nowhere. The Belaúnde government tried to return the economy to a more open system by reducing barriers to imports, implementing financial reforms intended to foster private markets, and reversing the statist orientation of the Velasco system. But the new approach never had a chance to get very far because of a series of macroeconomic problems. On one side, the government was rightly concerned about continuing inflation but made the mistake of focusing the explanation on monetary growth arising from the export surplus it inherited at the start. That position made it seem undesirable to continue trying to promote exports and desirable to raise domestic spending and imports. On the other side, President Belaúnde's personal and political objectives included using public investment actively to develop the interior of the country and to answer evident needs for improved infrastructure. Seeing the export surplus as the key macroeconomic source of imbalance, the government decided to eliminate it by removing import restrictions, slowing nominal devaluation to allow the real exchange rate to appreciate, and increasing government investment spending.

The real exchange rate appreciated through 1981 and 1982, public sector investment rose 54 percent in real terms from 1979 to 1982, and public sector consumption rose 25 percent during the same three-year period. The combination effectively turned the current-account surplus into a large deficit, as increased spending plus import liberalization practically doubled imports of goods and services between 1979 and 1981. The appreciation also turned manufacturing exports back downward, and a plunge in external prices of primary exports brought them down too. And then the mistake of focusing on the earlier export surplus as the main cause of inflation became clear: the increases in spending led to a leap of inflation despite the return to an external deficit. The rate of inflation went from 59 percent in 1980 to 111 percent by 1983.

Nothing improved when the government then tried to go into reverse with contractionary macroeconomic policies and renewed depreciation. Output plunged, but inflation once more went up instead of down, to 163 percent by 1985. By this time, pessimism about the government's capacity to solve anything, inflationary expectations turning into understandable convictions, and the price-increasing effect of devaluation all combined to give Peru a seemingly unstoppable inflation despite the elimination of anything that might be considered excess demand. The government apparently lost its sense of direction, retreated from its attempt to reopen the economy by returning to higher tariff levels, and otherwise did little except wait for its own end in 1985.

The First Alan García Government 1985–1990[]

With the market-oriented choice of economic strategy discredited by results under Belaúnde, Peruvians voted for the dynamic populist-reformist promise of García and responded enthusiastically to his sweeping changes. García's program worked wonders for two years, but then everything began to go wrong.

The main elements of the economic strategy proposed by the García government were full of promise. They recognized the prior neglect of the agricultural sector and called for redirecting public programs toward promotion of agricultural growth and reduction of rural poverty. Correspondingly, economic activity was to be decentralized to break down its high concentration in Lima, and within the cities resources were to be redirected away from the capital-intensive and import-intensive modern sector to the labor-intensive informal sector. A strategy of concertación (national understanding) with private business leaders on economic issues was to be used systematically to avoid disruptive conflict. Problems of external balance were to be answered both by restructuring production to lessen dependence on imports and by reorienting toward higher exports over the long-term.

These goals for structural change could have improved the efficiency of resource allocation while doing a great deal to lessen poverty. But the goals clearly required both time and the ability to restore expansion without worsening inflation and external deficits. The government initially emphasized such macroeconomic objectives as necessary conditions for the structural changes. The first step was to stop the built-in inflationary process, but to do it without adopting orthodox measures of monetary and fiscal restraint.

The first 2 years 1985–1987[]

The first two years of the García government gave new hope to the people of Peru, with rising employment, production, and wages suggesting a clear turn for the better after so many years of increasing difficulties. It was hence doubly tragic to see the whole process unravel so quickly, once things started going wrong again. The first sign of trouble came, as it often had, from the balance of payments. The economic boom naturally raised imports swiftly, by 76 percent between 1985 and 1987. But the real exchange rate was allowed to fall by 10 percent in 1986 and by a further 9 percent in 1987. The boom pulled potential export supply into the domestic market, and the fall in the real exchange rate reduced incentives to earn foreign exchange. Exports fell slightly in 1985 and remained below that level through 1987. The external current account went from a surplus of US$127 million in 1985 to deficits of nearly US$1.1 billion in 1986 and nearly US$1.5 billion in 1987.

Besides higher employment and living standards, the first two years of economic revival seemed to offer a break in the cycle of rising rural violence. The flow of displaced peasants from the Sierra eased, and a good many peasants began to return to the countryside.

To stop inflation, the government opted for heterodox policies of control within an expansionary program. Prices and wages in the modern sector were to be fixed, after an initial one-shot increase in wage rates. The increase in wages was intended to raise living standards of workers and stimulate production by raising sales to consumers. To offset the effects of higher wages on costs of production, financial costs of the business sector were cut by intervention in order to reduce and control interest rates. After making one adjustment of the exchange rate to minimize negative effects on exports, the government stopped the process of continuing devaluation in order to help hold down inflation. Imports were rightly expected to go up as the economy revived; to help finance them, García made his controversial decision to stop paying external debt service beyond 10 percent of the value of exports. Unorthodox as they were, all the pieces seemed to fit. At least, they went together well at the start under conditions of widespread idle capacity, with an initially strong balance of payments position.

The macroeconomic measures worked wonders for production. GDP shot up 9.5 percent in 1986 and a further 7.7 percent in 1987. Manufacturing output and construction both increased by more than one-fourth in these two years. An even greater surprise was that agricultural production per capita went up, running counter to its long downward trend. And the rate of inflation came down from 163 percent in 1985 to 78 percent in 1986, although it edged back up to 86 percent in 1987. In response to stronger market conditions and perhaps also to growing confidence that Peru's economic problems were at last being attacked successfully, private fixed investment went up by 24 percent in 1986, and capital flight went down.

The government avoided any spending spree of its own: central government spending was actually reduced in real terms each year. But because the government also reduced indirect taxes in order to encourage higher private consumption and to reduce costs for private business, its originally small deficit grew each year. The economic deficit of the nonfinancial public sector as a whole (excluding interest payments) went up from 2.4 percent of GDP in 1985 to 6.5 percent by 1987.

Although the government reduced its total spending, it managed to support a new public works program to provide temporary employment and to direct more resources to rural producers as intended in its program for structural change. Three lines of policy helped especially to raise rural incomes. The first was to use generous guaranteed prices for key food products. The second was to provide greatly increased agricultural credit, financed essentially by credit from the Central Bank. The third was to exempt most of the non-guaranteed agricultural prices from controls, allowing their prices to rise sharply relative to those of industrial products from the modern sector. From July 1985 to December 1986, prices of goods and services not under control increased more than three times as much as those under control. Wholesale prices in manufacturing increased 26 percent, but those for agricultural products increased 142 percent.

From inflation to hyperinflation, 1988–1990[]

The García government reacted to the growing external deficit in exactly the same way as had the governments of Velasco and of Belaúnde—by postponing corrective action while the problem continued to worsen. As ever, a major fear was that devaluation would worsen inflation. Inflationary pressures were, in fact, beginning to worsen behind the façade of control. To some degree, they were growing in response to the high rate of growth of demand and output, reducing margins of previously underutilized productive capacity. But the more explosive pressures were being built up by relying on price controls that required a dramatic expansion of credit to keep the system in place. Prices of public sector services—gasoline above all, oil products in general, electricity, telephones, and postal services—were frozen at levels that soon became almost ridiculous in real terms. The restrictions on prices charged by state firms drove them ever deeper into deficits that had to be financed by borrowing. The borrowing came from wherever it could, but principally from the Central Bank. At the same time, Central Bank credit rose steadily to keep financing agricultural expansion. Still another direction of Central Bank credit creation was the financing used to handle the government's new structure of multiple exchange rates. Differential rates were used to hold down the cost of foreign exchange for most imports, again with the dominant goal of holding down inflation, while higher prices of foreign exchange were paid to exporters to protect their incentives to export. The Central Bank thus paid more for the foreign exchange it bought than it received for the exchange it sold.

The term used for these leakages—for extensions of Central Bank credit that did not count in the government's budget deficit—is the "quasi-fiscal deficit." Its total increased from about 2 percent of GDP in 1985 to about 4 percent in 1987. Meanwhile, the government's tax revenue fell steadily in real terms, partly because of tax reductions implemented to hold down business costs and partly because of the effect of inflation in cutting down the real value of tax payments. Added together, the fiscal deficit plus the quasi-fiscal deficit increased from 5 percent of GDP in 1985 to 11 percent by 1987.

The two horsemen of this particular apocalypse—the external deficit and the swift rise of Central Bank credit—would have made 1988 a bad year no matter what else happened. But President García guaranteed financial disaster by his totally unexpected decision in July 1987 to nationalize the banks not already under government ownership. No one has yet been able to explain why he decided to do so. It would not seem to have been a move necessary for any component of his program, or needed for government control in a banking sector in which it already had a dominant position. In any case, the action underlined the unilateral character of economic policy action under Peru's presidential system and wrecked any possibilities of further cooperation with private sector leadership. Private investment began to fall, and the whole economy followed it down shortly thereafter.

The García government tried a series of major and minor new policy packages from early 1988 into 1990 to no avail. The new policies never succeeded in shutting off the rapid infusion of Central Bank credit that was feeding inflation, even when they did succeed in driving production down significantly in 1989. Manufacturing production fell 18 percent in that year, agricultural output 3 percent, and total GDP 11 percent. Simultaneously, inflation increased from a record 666 percent in 1988 to a new record of 3,399 percent for 1989. The one positive change was the external current-account deficit: the fall in domestic production and income was so steep that the current account went from a deep deficit to a substantial surplus. The internal cost was perhaps clearest in terms of real wages: the minimum wage in real terms for urban labor fell 61 percent between 1987 and 1989, and average real wages in manufacturing fell 59 percent.

Critics of García's presidency claim that his many poor decisions while in office created an environment that led to the rise of an authoritarian leader like Alberto Fujimori, who came to power in 1990. Fujimori implemented drastic measures that caused inflation to drop from 7,650% in 1990 to 139% in 1991. Faced with opposition to his reform efforts, Fujimori dissolved Congress in the auto-golpe of April 5, 1992. He then revised the constitution; called for new congressional elections, and undertook a process of economic liberalization which put an end to price controls, discarded protectionism, eliminated restrictions on foreign direct investment and privatized most state companies.[3] The reforms allowed sustained economic growth, except for a slump after the 1997 Asian financial crisis.[4]

However, by 1990 the neoliberal government of Alberto Fujimori ended abruptly the soviet minded economic policies with the so-called Fujishock of August 7, 1990.

The Fujimori Government 1990–2000[]

Alberto Fujimori served as President of Peru from 28 July 1990 to 17 November 2000. A controversial figure, Fujimori has been credited with the creation of Fujimorism, defeating the Shining Path insurgency in Peru and restoring its macroeconomic stability.[50][51][52][53] Fujimori's economic policy was largely adopted from the advice of Peruvian economist Hernando de Soto, who prescribed economic guidelines – including the loosening of economic regulation, the introduction of austerity measures and the utilization of neoliberal policies – that were ultimately adopted by the Fujimori administration and established in the 1993 Constitution of Peru.[54][55][56][57] The policies utilized by de Soto and Fujimori resulted with increased misery for poor Peruvians as de Soto's prescribed "Fujishock" caused increased prices and little change to the poverty rate.[36] Eventually, the policies resulted in Peru becoming macro-economically stable following the period of price controls and increased regulation established during the Lost Decade.[36][32]

Fujimori has been criticized for his authoritarian way of ruling the country and was accused of human rights violations.[58][59] Fujimori was ultimately arrested and convicted for human rights violations, murder, bodily harm, two cases of kidnapping, embezzlement of $15 million given to his intelligence service chief, Vladimiro Montesinos and bribery, being sentenced to twenty-five years in prison.[60][61][62][63][64][65]

Fujishock[]

During his first term in office, Fujimori enacted wide-ranging neoliberal reforms, known as Fujishock. During the presidency of Alan García, the economy had entered a period of hyperinflation and the political system was in crisis due to the country's internal conflict, leaving Peru in "economic and political chaos".[66] In a recommendation to Fujimori, neoliberal economist Hernando de Soto, who helped promote the Washington Consensus among Latin American countries, called for a "shock" to Peru's economy.[67][36] De Soto convinced Fujimori to travel to New York City in a meeting organized by the Peruvian Javier Pérez de Cuéllar, secretary general of the United Nations, where they met with the heads of the International Monetary Fund, the World Bank, and the Inter-American Development Bank, who convinced him to follow the guidelines for economic policy set by the international financial institutions.[36][68] The policies included a three-hundred percent tax increase, unregulated prices and privatizing two-hundred and fifty state-owned entities.[36] This program bore little resemblance to his campaign platform and was in fact more drastic than anything Vargas Llosa had proposed.[69] The IMF was impressed by these measures, and guaranteed loan funding for Peru.[70]

In practice, new measures came out in bits and pieces, dominated by immediate concern to stop inflation; actions taken in the first year did not complete the program.[71] Fujimori's initiative relaxed private sector price controls, drastically reduced government subsidies and government employment, eliminated all exchange controls, and also reduced restrictions on investment, imports, and capital flow.[72] Fujimori's privatization campaign featured the selling off of hundreds of state-owned enterprises, and the replacing of the country's troubled currency, the inti, with the Nuevo Sol.[66] Tariffs were radically simplified, the minimum wage was immediately quadrupled, and the government established a $400 million poverty relief fund.[72] The latter measure seemed to anticipate the economic agony that was to come, as electricity costs quintupled, water prices rose eightfold, and gasoline prices rose 3000%.[69][72] Those living in poverty saw prices increase so much that they could no longer afford food.[36]

Effects[]

Fujishock succeeded in restoring Peru to the global economy, though not without immediate social cost.[72] The policies recommended by de Soto and implemented by Fujimori led to the immediate suffering of poor Peruvians who saw unregulated prices increase rapidly.[36] Over time, however, the policies caused macroeconomic stability and a reduction in the rate of inflation, foreign investment capital increased and in 1994, the Peruvian economy grew at a rate of 13%, faster than any other economy in the world.[36][70][56][73]

Peru's poverty rate remained largely unchanged, however, with over half of the population living in poverty by 1998.[74] Some analysts state that some of the GDP growth during the Fujimori years reflects a greater rate of extraction of non-renewable resources by transnational companies; these companies were attracted by Fujimori by means of near-zero royalties, and, by the same fact, little of the extracted wealth has stayed in the country.[75][76][77][78] Peru would not see its largest growth until the 2000s commodities boom.[79][80]

In addition to the nature of democracy under Fujimori, Peruvians became increasingly interested in the myriad of criminal allegations involving Fujimori. In the 2004 Global Transparency Report, Fujimori made into the list of the World's Most Corrupt Leaders. He was listed seventh and he was said to have amassed $600 million USD.[81][82] Even amid his prosecution in 2008 for crimes against humanity relating to his presidency, two-thirds of Peruvians polled voiced approval for his leadership in that period.[83]

The Toledo government 2001–2006[]

Alejandro Toledo claimed he was a living proof of The Peruvian Miracle.[84] Toledo began shining shoes and selling lottery tickets as a boy in the Andes. A half century later, he had ascended to become Peru's first aboriginal president, the nation's highest office, serving as president from 2001 to 2006. “I’m part of the margin of error. To come from extreme, extreme poverty, to have gone to the University of San Francisco, to Stanford, to teach at Harvard, to be part of the World Bank and the United Nations and be a president. Let me tell you, I’m the result of a statistical error. But I have millions of people who come from my own roots, millions of Amazonians, Afro-Peruvians, who don’t have the chance to have access to potable water and sanitation, to quality health care, and sanitation. No access to energy. And that’s a population that’s very discontented, and today getting together. We need to construct a society that is much more inclusive.”[85]

During his campaign, Alejandro Toledo promised Peruvians higher wages, a fight against poverty, anti-corruption measures, higher pensions, more employment, military reform, development of tourism, and industrialization. As Peru's top economist Pedro Pablo Kuczynski noted “Toledo comes after almost 30 years of either dictatorships or governments that weren't so democratic. People expect Toledo to solve all the problems of the last 30 years, which included an enormous increase in relative poverty."[86]

Toledo's inability to fulfill many of these promises created widespread dissatisfaction. His approval ratings were consistently low throughout his presidency, sometimes sinking into single digits. Toledo also promised open market free trade reforms, which reflected Peru's business interests while also promising to review Fujimori's privatization programs. Specifically, Toledo promised not to privatize any of Peru's public utilities. This promise, combined with lofty promises of reduced unemployment and poverty, caused Peru's rank and file to set the bar very high for his administration. Shortly after coming to office Toledo met with IMF officials and promised that he would raise $700 million in 2002, and almost one billion dollars in 2003, by selling state assets.[87]

Toledo's economic policies can be described as neoliberal or strongly pro free-trade. He inherited a national economy which in the previous decade had experienced an unstable GDP with periods of growth and shrinkage, as well as fiscal deficits frequently amounting to over 2% of GDP. Inflation had not dropped below 23% until 1995 and was still feared by many. In response, Toledo developed policies which focused on fighting poverty, generating employment, decentralizing government, and modernizing the state.[88]

Among Toledo's initiatives designed to generate revenue and transform the economy were plans to privatize national industries. The first major effort of this kind was the $167 million sale of two state-owned electric companies. Protests in the city of Arequipa turned violent as Peruvians reacted with anger to the prospect of layoffs and higher priced electricity. They also recalled that billions of dollars earned from privatization under the Fujimori administration had ended up filling the president's personal bank accounts. Toledo decided not to carry out the sale of electric companies, but promised to continue privatization efforts, which were a key provision of a deal struck with the International Monetary Fund. Toledo had promised to bring in US$700 million through privatization in 2001 and US$1 billion in 2002.[89] Although he failed to meet these goals, the IMF approved a $154 million disbursement to Peru in December 2002 and allowed the country to raise the fiscal deficit target in its agreement.[90]

To compound his problems, President Toledo faced a devastating earthquake in his first year in office. This natural disaster left much of Peru morally and fiscally devastated. With many homes and businesses destroyed, economic ills were exacerbated.[91]

Although Toledo originally promised tax cuts, violent protests by civil servants prompted the increase in social sector spending that Toledo had also promised, which necessitated tax increases. To tackle tax reform in June 2003, he brought in Peru's first female prime minister, Beatriz Merino who quickly submitted proposals to the congress. Among the suggestions were pay cuts for higher-paid public-sector officials, including a 30% salary reduction for Toledo himself, a 5% across-the-board cut for all agencies and ministries, tax increases on beer, cigarettes and fuel, and an extension of the 18% sales and value-added tax to, among other things, long-distance bus journeys and live entertainment.[92] The final package also included the elimination of tax breaks, the introduction of a minimum corporate tax, the closing of tax loopholes for the rich, and the strengthening of local government realestate tax regimes.[90]

During Toledo's five years as president, Peru's economy experienced 47 consecutive months of growth and grew at an average rate of 6% per year while inflation averaged 1.5% and the deficit sank as low as 0.2% of GDP. Between 2004 and 2006, employment grew at an average rate of 6%,[93] the percentage of people living in poverty fell, and food consumption by the poorest segments of the population rose dramatically.[94] Much of this growth has been credited to the free trade agreements signed with the United States, China, Thailand, Chile, Mexico, and Singapore.[95][96]

Peru - United States Trade Promotion Agreement[]

The United States – Peru Trade Promotion Agreement (Spanish: Tratado de Libre Comercio Perú – Estados Unidos) is a bilateral free trade agreement, whose objectives are eliminating obstacles to trade, consolidating access to goods and services and fostering private investment in and between the United States and Peru. Besides commercial issues, it incorporates economic, institutional, intellectual property, labor and environmental policies, among others. The agreement was signed on April 12, 2006; ratified by the Peruvian Congress on June 28, 2006; by the U.S. House of Representatives on November 2, 2007 and by the U.S. Senate on December 4, 2007. The agreement was implemented on February 1, 2009.[97]

Peru looks to the agreement are to:

- Consolidate and extend the trade preferences under ATPDEA

- Attract foreign investment

- Generate employment

- Enhance the country's competitiveness within the region

- Increase workers' income

- Curb poverty levels

- Create and export sugar cane ethanol[98]

The United States looks to the agreement to:

- Improve access to goods and services

- Strengthen its investments

- Promote security and democracy

- Fight against drug trafficking

The U.S.-Peru agreement has faced criticism. In Peru, the treaty was championed by Toledo, and supported to different extents by former President Alan García and candidates Lourdes Flores and Valentín Paniagua. Ollanta Humala has been its most vocal critic. Humala's Union for Peru won 45 of 120 seats in Congress in 2006, the largest share by a single party, prompting debate on ratification of the agreement before the new legislature was sworn in. Some Congressmen-elect interrupted the debate after forcibly entering Congress in an attempt to stop the agreement ratification.[99]

One controversial element of the agreement relates to land resources. Laura Carlsen, of the Center for International Policy, who is also a contributor to Foreign Policy in Focus notes that "Indigenous organizations warn that this ruling effectively opens up 45 million hectares to foreign investment and timber, oil, and mining exploitation."[100]

However, most of the criticism of the agreement has focused on its potential impact on Peru's agricultural sector. By planting crops to similar to those subsidized by the U.S., Peru faced a competitive disadvantage in the production of agricultural products because poor farming families with inadequate tools, technology and techniques may not be able to produce crops at low enough prices to export. In response to these concerns, Peruvian lawmakers created a Compensation Fund which directed $34 million per year to cotton, maize/corn, and wheat producers for a five-year period to help them adjust to the new competitive pressures.[101]

Toledo is therefore a market-oriented politician who continued to globalize Peru's economy and is rumored to be getting ready for another run for president. Toledo says bluntly that unless the poorest in the country are better educated, better paid, housed, and fed, the Peruvian economic miracle will stall.

Acuerdo Nacional[]

In November 2001, Toledo opened talks which concluded in the National Accord of July 22, 2002. In the accord, seven political parties and seven social organizations agreed upon a framework that would guide policy for the next twenty years. The accord set forth twenty-four policy goals divided into four categories: democracy and the rule of law, equity and social justice, economic competitiveness, and an institutional framework of efficiency, transparency, and decentralization. Initially, the accord opened up dialogue in Peru's political arena, but within a year, the public considered it to be less effective than had been hoped.[102]

Maria Elena García calls the years of Toledo's presidency a transition rife with new opportunities for indigenous people, noting the “reframed state-indigenous interactions”, “increase in NGO projects and social movements”, and “proliferation of indigenous organizations.”[103] Toledo created and first lady Eliane Karp headed a new agency for indigenous and Afro-Peruvian affairs, CONOPA (Commission for Amazonian, Andean, and Afro-Peruvian Peoples). The agency was meant to establish a development agenda for indigenous communities, provide representation of indigenous interests within the government, and lead the way for multicultural constitutional reforms. Some critics viewed these actions as a state co-optation of indigenous identity, mockingly dubbing the agency the "Karp Commission".[104] However, Oxfam's Martin Scurrah points out the agency's good work, noting that in addition to promoting a chapter on indigenous rights in the new constitution, Eliane Karp has "intervened on numerous occasions in support of or in defense of indigenous initiatives."[103]

Toledo also brought serious attention to bilingual education in indigenous schools, creating a new and well-staffed division within the Ministry of Education devoted to the issue. This effort gives advocates greater autonomy and opportunity to influence policy and work toward institutionalizing bilingual education.[105]

Toledo's efforts at decentralization sought to give indigenous groups greater influence upon policy-making on a regional level. The first regional and local elections, held in November 2002, required that 15% of the candidates in regions with an indigenous presence must have indigenous backgrounds. However, decentralization has been viewed critically by some, who claim that in dividing up regions, administrators have at times ignored the distinctive cultural and historical factors that define different areas.[106]

In a speech to the Human Rights of Indigenous Peoples in Latin America conference, Toledo expressed disappointment at the growing disparity between the incomes of indigenous people and other citizens. Despite the growth achieved by the Peruvian economy, the poverty gap has widened between the upper and lower classes. Toledo mentions the reintegration of the indigenous populations into the Peruvian social and political system as a key to sustainability and economic growth.[107]

Advocates of indigenous rights have also criticized some of Toledo's efforts to jump-start the economy through investments, such as his support for the Camisea natural gas project and other projects that involved exploring or developing natural resources. These critics claim that companies buy land at unreasonable prices, force indigenous people off of land that is historically theirs, and exploit natural resources in ways that are harmful to communities and the environment. Peru is one of the largest producers of gold, silver, and zinc in Latin America, and some critics complain about the priority the Peruvian government gives to mining as opposed to industries like fishing and agriculture, with which indigenous peoples are more familiar. They note that mining companies may bring new jobs to rural areas, but that they are not jobs for which natives are well qualified.[106]

Despite unprecedented, strong, and consistent economic growth under his leadership, Toledo dealt with much labor unrest during his presidency as workers demanded higher wages and the fulfillment of campaign promises. The crisis underlined a basic flaw in Peru's economy as pointed out by The Economist, which noted that "some 70% of output falls within the grey or informal" economy, and thus escapes tax. Tax-collections, at below 12.1% of GDP, are stagnant, with most coming from a handful of large, formal companies. Evasion is widespread, particularly among better-paid independent professionals." Tax collections by Toledo's government could simply not cover the wages that had been promised to civil servants.[108]

Even as the Peruvian government was taking in too little money to pay civil servants, the country saw its cost of living increase dramatically during the early years of Toledo's administration. These hardships, combined with increasing unemployment and stagnant wages caused the general public to doubt that Toledo was living up to lofty campaign promises. By 2003, Toledo's approval rating had fallen below 10%, the lowest of any South American president at the time.[109]

Toledo did implement some of his plans for investment in social infrastructure and institutions. The amount of paved roads increased by 20% during his presidency; medical attention to the poor doubled in rural areas, and public sector salaries increased (school teachers' pay rose by 87%) and over 100,000 new homes were built for poor Peruvians.[94]